Riya Grover

The Global CFO Playbook for International Billing & Compliance

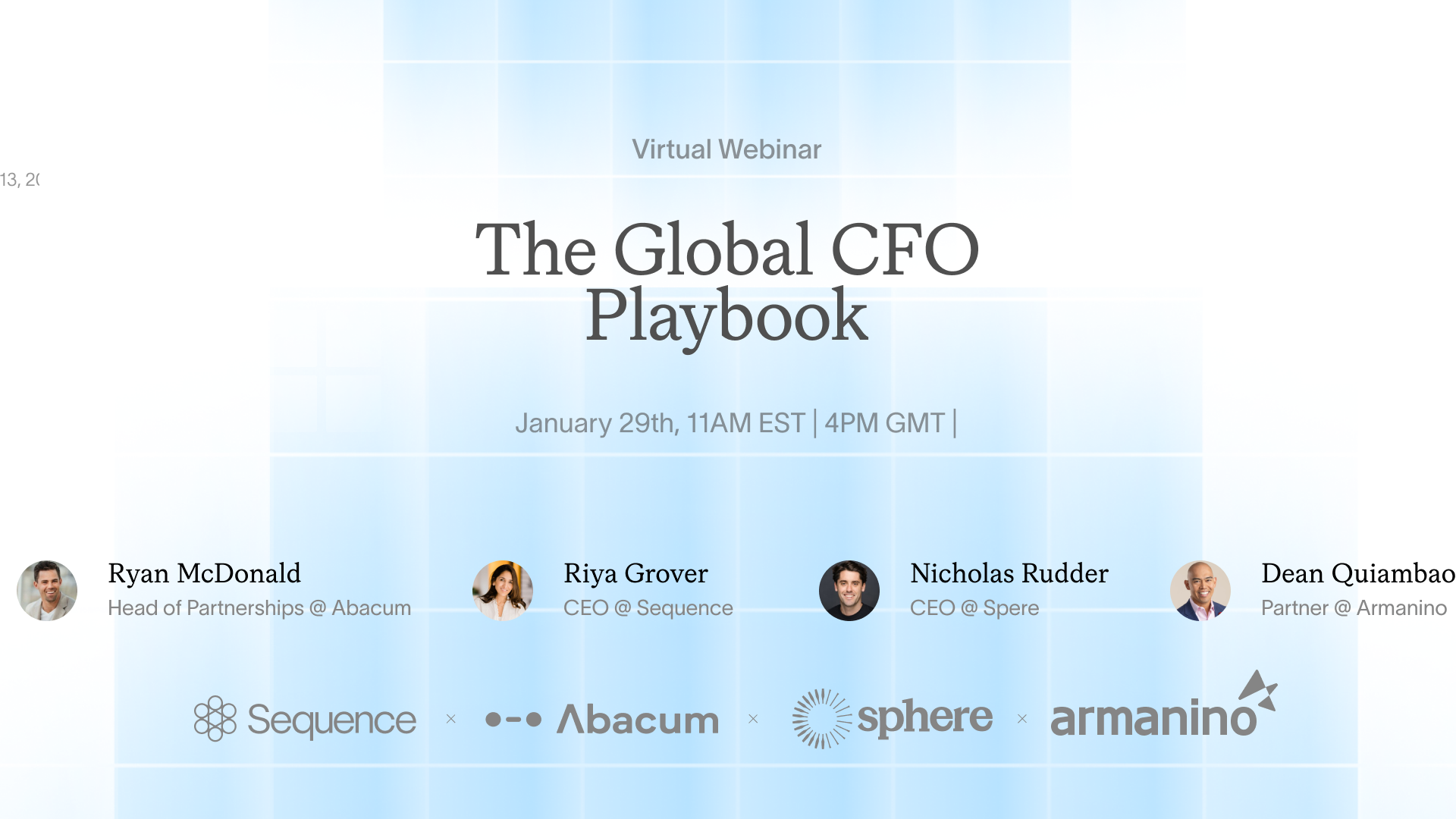

A conversation with Abacum and Sphere on international billing, multi-currency pricing, and cross-border tax compliance for finance teams scaling globally.

Why integrated billing, planning, and tax systems matter

The most painful problems in international finance come from having data scattered across disconnected systems. Quote-to-cash has historically been fragmented – you might use one system for metering, another for billing, a separate CPQ tool, and suddenly you've got two different product catalogs: one for sales, one for finance. Conflicting sources of truth everywhere.

This gets exponentially worse when you expand internationally. You're not just managing complexity in one market – you're multiplying it across every new geography.

Nick Rudder sees the same thing on the tax side at Sphere. "People just want one integrated system. They don't want this patchwork of advisors and different software. It's even more important now because tax authorities are getting aggressive – more audits, more notices. That's where your data really gets put under the microscope."

Ryan added that financial planning faces the same pressure. "The CFO is more like the Chief Performance Officer now. They need to see everything – revenue combined with headcount, product data, accounting data from your GL."

International billing requires more than currency conversion

Companies often assume international expansion just means flipping the currency symbol on invoices. It's not.

Pricing often needs to change completely when you enter new markets. What works in the US might not fit the competitive dynamics in Europe or APAC. It's common for companies to have one set of SKUs and pricing models for one market and something entirely different for another.

This means you need real flexibility on the pricing and billing side – not forcing a single structure across markets where it doesn't fit.

Cross-border tax compliance adds up fast

Nick brought some numbers that get people's attention. International indirect tax rates aren't the 7-9% sales tax American companies are used to. "We're talking 21%. It can be big."

And the damage goes beyond penalties. "It stops deals. Withholding tax can get stuck in negotiation, drag on for months, sometimes kill the deal entirely. We look at it from a revenue perspective – unlocking new markets, making it as easy as selling locally."

Sphere has built direct integrations with over 100 tax authorities worldwide, automating registration, calculation, filing, and remittance for sales tax, VAT, and GST.

Multi-entity planning is harder than it looks

Ryan emphasized that Abacum built for international complexity from day one. "We've got clients across 40 countries. A lot of companies, especially in APAC, have a bunch of Xero files and NetSuite files all plugging into one instance of Abacum. We standardize all those general ledgers into one place."

The challenge isn't just consolidating data – it's maintaining flexibility while handling different charts of accounts, currencies, and reporting requirements across subsidiaries.

"Make sure you really understand how you're going to work with different entities," Ryan said. "You've got a different chart of accounts in Spain than the US. How does that flow into a standardized view for management reporting?"

Modern CFOs run lean international teams

When asked what separates the most effective finance orgs scaling globally, Nick's answer was counterintuitive: "The most modern CFOs and controllers operate on really lean teams. Small. They're not burning the midnight oil doing crazy manual work. It's about trimming manual workflows, putting automation in, and having clean data."

He pointed to customers preparing for IPO who run with just a head of finance, a controller, and maybe one tax person. The secret isn't working harder – it's building automation into billing, planning, and compliance from the start.

Will your tech stack work internationally?

One thing companies overlook when picking billing tools: will this actually work when we expand?

It gets tricky when you enter a new market and realize your tech stack doesn't service it. You don't want to run two expense management tools in different regions. As you adopt products in any of these spaces, think about whether they'll work internationally. You don't want to maintain two billing platforms.

See how Sequence handles international billing

If you're expanding into new markets or already managing multi-currency billing complexity, we'd love to show you how Sequence can simplify your order-to-cash workflow. Book a demo and we'll walk through how our AI-native platform handles the pricing flexibility, contract variations, and revenue recognition challenges that come with global growth.

Riya Grover

Related articles

Get Invoicing or Paid Trying: Our New Monthly Webinar

We're running a monthly webinar where we model complex pricing scenarios live in Sequence. Bring us the contract your current billing system can't handle - the one that needs manual workarounds every month. We'll work through the pricing structure (your commercial details stay anonymous). If we can handle it, we’ll offer to buy you out of your existing vendor contract. If we can't, we'll buy you a free breakfast or lunch.

Enda Cahill

Agents in Financial Operations, with Sequence, Ramp and Campfire

Hear from Riya Grover (Sequence), Dave Wieseneck (Ramp) and John Glasgow (Campfire), as they demo agentic workflows across the finance stack and dive into how AI agents are reshaping finance operations. The conversation revealed how three companies are moving beyond traditional chatbots to embed intelligent agents directly into critical finance workflows.

Enda Cahill

Financial Planning and Budgeting in a Downturn, with Sequence, Ramp and Vanta

Hear from Finance leaders David Eckstein (Vanta) and Alex Song (Ramp) in this wide ranging conversation about managing cash and trading short-term profitability with investing for long-term growth.

Riya Grover