Riya Grover

Sequence secures $20M Series A

to build AI agents that automate revenue operations

We’ve secured $20m to automate revenue operations for next generation finance teams

Today marks a big milestone for us. Announcing our $20M Series A led by 645 Ventures, alongside a16z, Firstminute Capital, Vor Capital, Passion Capital, Dig Ventures. A group of world class founders and execs including the CFOs at Decagon, Klaviyo and Wise also joined the round.

Sequence has had record 10x ARR growth this year, with hundreds of finance teams like Cognition, Legora, Bridge, 11x, incident.io, Runway and Moonpay choosing Sequence to automate their revenue collection.

Sequence has eliminated the most manual and painful parts of revenue operations from billing and invoice automation to real-time revenue recognition, turning days of work into an automated workflow. This round, which brings us to $38m raised, fuels us to build the next frontier in AI first finance automation.

Quote to Cash is ready for AI based disruption

Despite innovation in spend management, payroll and payments in the last decade, revenue workflows (pricing, billing, collections, revenue recognition) have lagged behind. RevOps and Finance teams rely on spreadsheets, manual processes, and fragmented tools that struggle with custom deals and modern pricing models.

Here’s what’s happening in finance teams everywhere - brilliant people spend >50% of their time on repetitive tasks like calculating invoices by hand, chasing unpaid bills, and reconciling transactions, while revenue slips through the cracks because complex contracts are hard to track.

"I started Sequence after a decade watching finance teams face an impossible choice: drown in manual billing work or rely on systems that break when sales teams close custom deals," said Riya Grover, CEO of Sequence.

Flexible pricing and billing tools to power revenue growth

And manual work is just one part of the problem. Even more concerning is when finance must create friction in deals by limiting what pricing can be offered, due to the constraints of the billing infrastructure. A lot of the legacy CPQ and billing systems are just unable to handle modern pricing models and contract structures that are used by teams today, such as usage tiers, seat overages, milestones, pricing ramps, temporary discounts and more.

We built Sequence differently. Under the hood is a robust foundational data model which can interpret any pricing model or bespoke contract structure. This has enabled us to offer a flexible and powerful revenue platform to streamline quoting, billing, invoicing and AR. And this matters more today than ever before. In this age of AI, businesses are scaling faster and iterating more on pricing. Finance can’t be a bottleneck to growth. Companies need a revenue engine that allows them to be agile in their go market.

Finance grade agents, built with observability and controls

If you look at anything in the domain of AI, data is what enables you to win. We capture data across the lifecycle of a contract. With this context, we’ve deployed AI strategically to automate tasks like contract intake, invoice review, and payment chasing, while keeping billing math fully deterministic and finance teams in control.

Our AI agents act as co-pilots to humans, helping finance teams to work more efficiently, and proactively spot trends or anomalies. Over time we envisage a world where humans do less work, and review more agent work. In this scenario, Sequence becomes a control plane for coordinating revenue workflows and agents.

Imagine you have an agent that parses sales contracts, answers billing questions, and reviews invoices automatically. Or an agent that calculates your sales commission, gives you reporting insights, and makes recommendations on pricing guardrails.

From a technical perspective, it's remarkable. But a user may be left asking, What just happened? What did the AI actually do? Can I trust it? Should I be worried that I didn't see it happen?

Resolving this tension between automation and observability requires interfaces that surface completed work in ways that build trust, demonstrate value, and enable control. This has been a core focus at Sequence. Here are a few ways we’re achieving this:

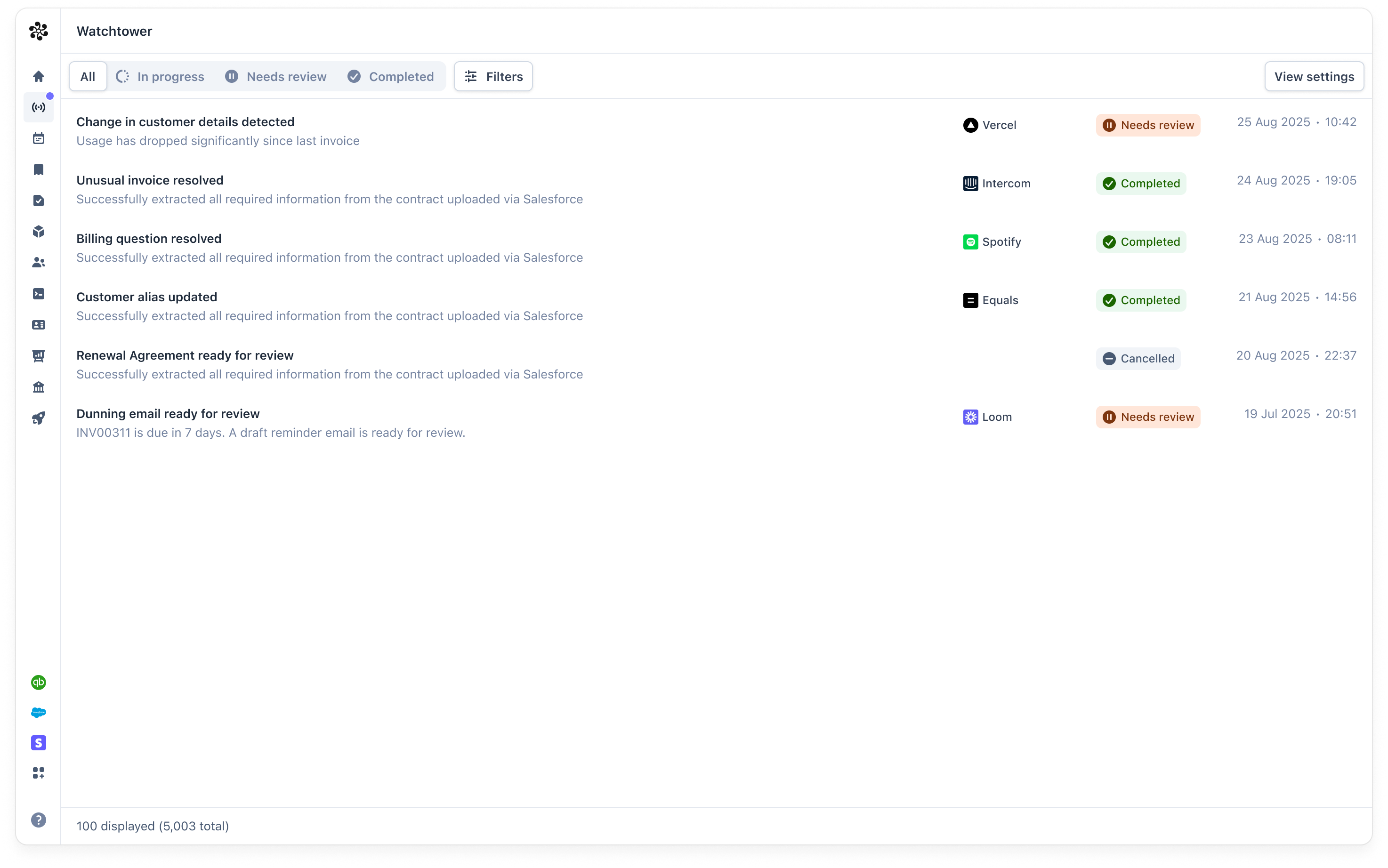

Command centers as a new interface

A new paradigm around human-in-the-loop interfaces is slowly emerging. These interfaces are a hybrid of an inbox, ticketing system and audit log.

Making AI decisions auditable by default

In sensitive domains like finance, work has to be auditable. Command centers log every action an agent takes. What it did, what data it used, what reasoning led to the outcome. Operators can trace any decision back to its source.

Surfacing invisible work

Command centers make autonomous work visible through activity feeds. Operators see exactly what was completed: 47 contracts processed this week, 3 items requiring review, etc. It now becomes straightforward to show value and that the agent is doing real work: "Our agents processed 2,400 contracts this quarter."

Handling approvals

Complex situations require human judgment and edge cases need manual review. Command centers serve as a unified interface for exceptions and escalations across all agent workflows.

The next chapter

This is just the beginning. Our rapid momentum has come from a relentless focus on building exceptional products in close partnership with customers - we ship with an extremely high standard for velocity and craft.

This fundraise enables us to execute on our mission of empowering finance teams with agents that increase efficiency while ensuring finance teams are in the loop, have full observability and obtain reliable and deterministic outcomes where it matters.

We’ve seen a huge shift in the market over the last year where instead of adding headcount, CFOs are looking to scale the finance function with AI based automation. There has never been more pent up demand, as modern companies need revenue infrastructure that keeps pace with their growth and helps finance teams to achieve greater leverage.

Two final asks:

- Are you still using legacy tools or experiencing manual chaos and want to improve this workflow? Get a demo here to learn more.

- Do you want to build the future of revenue automation? We're hiring in New York and London across many different roles. Learn more here.

Riya, Eamon & Enda

Co-founders, Sequence

Riya Grover

Related articles

Sequence + Rillet: The modern finance stack is here

The AI-native finance stack is forming, and next-gen ERPs like Rillet are at the center of it. Companies with established systems, such as NetSuite and Stripe Billing, are choosing to build their finance operations on Sequence for quote-to-cash and Rillet as their AI-native general ledger. With our new native integration, these systems now work together seamlessly. This matters because Sequence handles what legacy billing systems can't: multi-year ramped pricing, backdated contracts, percentage-based pricing, flexible usage minimums, mid-contract co-terms, and every other contract variation sales teams actually close. When you pair that flexibility with Rillet's AI-native ERP, finance teams finally get both: the ability to bill any contract accurately and the intelligence to close books in hours instead of weeks.

Killian Cahill

2025 in Review

2025 was our strongest year yet - driven by 10× revenue growth, a $20m Series A, alongside 60+ brand new customer-facing product launches.

Killian Cahill

Building a human in the loop interface

We're starting to see the early signs of a new operating model for software. One where agents anticipate what operators need and complete multi-step workflows autonomously. Instead of humans operating software, humans oversee agents operating the software.

Merlin Kafka