<1 month

To migrate 100+ customers from Chargebee to Sequence12%

Reduction in revenue slippage78%

Reduction in finance and engineering monthly billing timeSchedule your demo and get started in hours.

Weavr powers embedded financial solutions for leading B2B SaaS platforms including Ben and Finway.

The Challenge

- Find a more flexible replacement for Chargebee with a frictionless migration process

- Automate billing for highly complex, usage-based / custom contracts

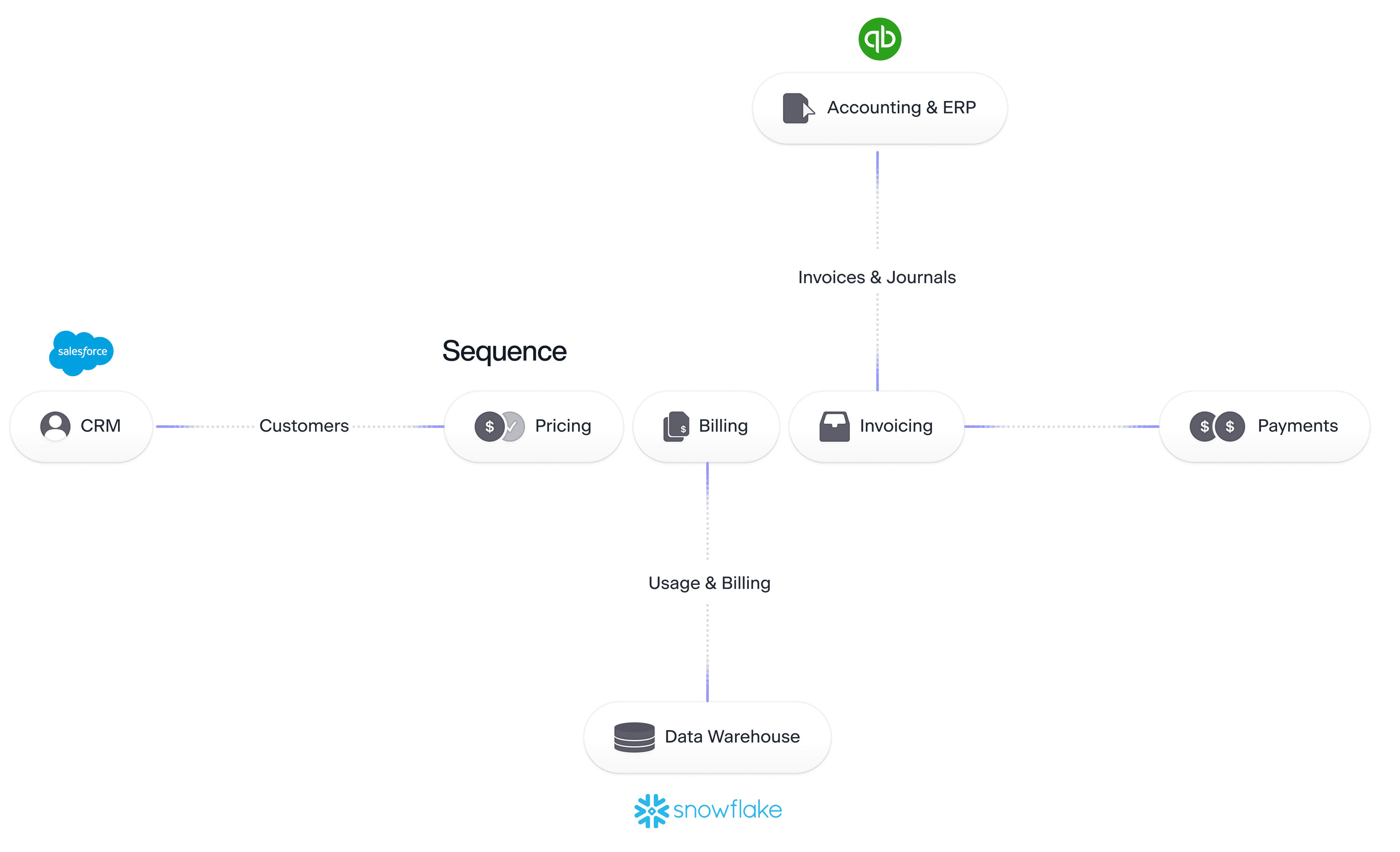

- Deep integrations required across Snowflake <> Billing Engine <> QuickBooks

“Working with Sequence on data integration for our billing module has been a seamless and productive experience. Their team's expertise, responsiveness, and commitment to delivering high-quality solutions have significantly streamlined our processes and added real value to our operations. Integration has been especially smooth thanks to the ability to send transactional-level data, which has made the process both flexible and efficient. Additionally, the integration with Snowflake has greatly simplified our reporting, enabling faster and more insightful analysis.”

- Robert Mifsud Bonnici, Head of Data

The Solution

Managed Chargebee migration service

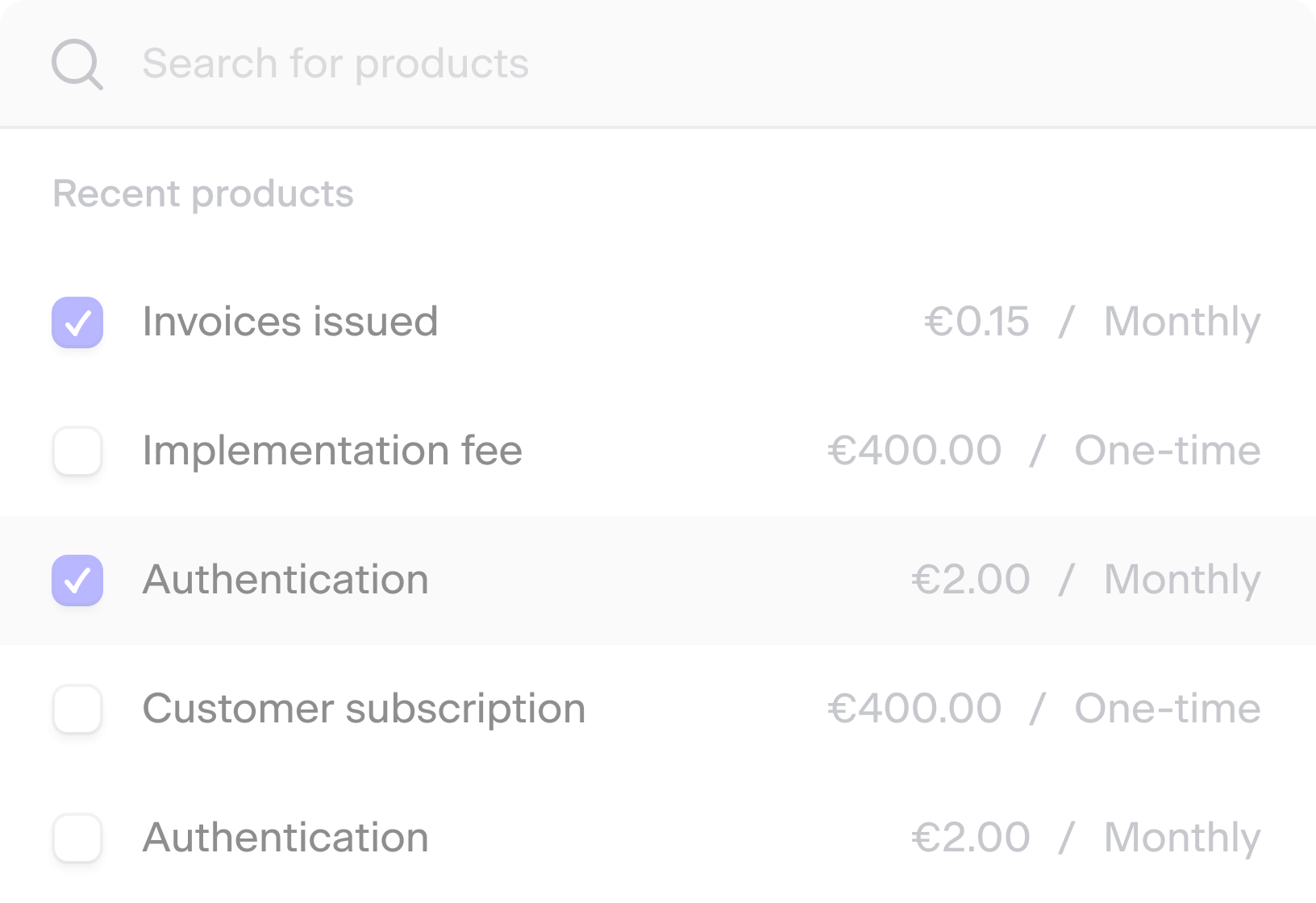

Our dedicated Chargebee migration team took on the onboarding work to move all customers, subscriptions and 100+ products from Chargebee into Sequence. This included a full clean up of any duplicate products and redundant subscriptions to obtain a clean source of truth on all billing activity, resulting in an accurate reporting model of their revenue function.

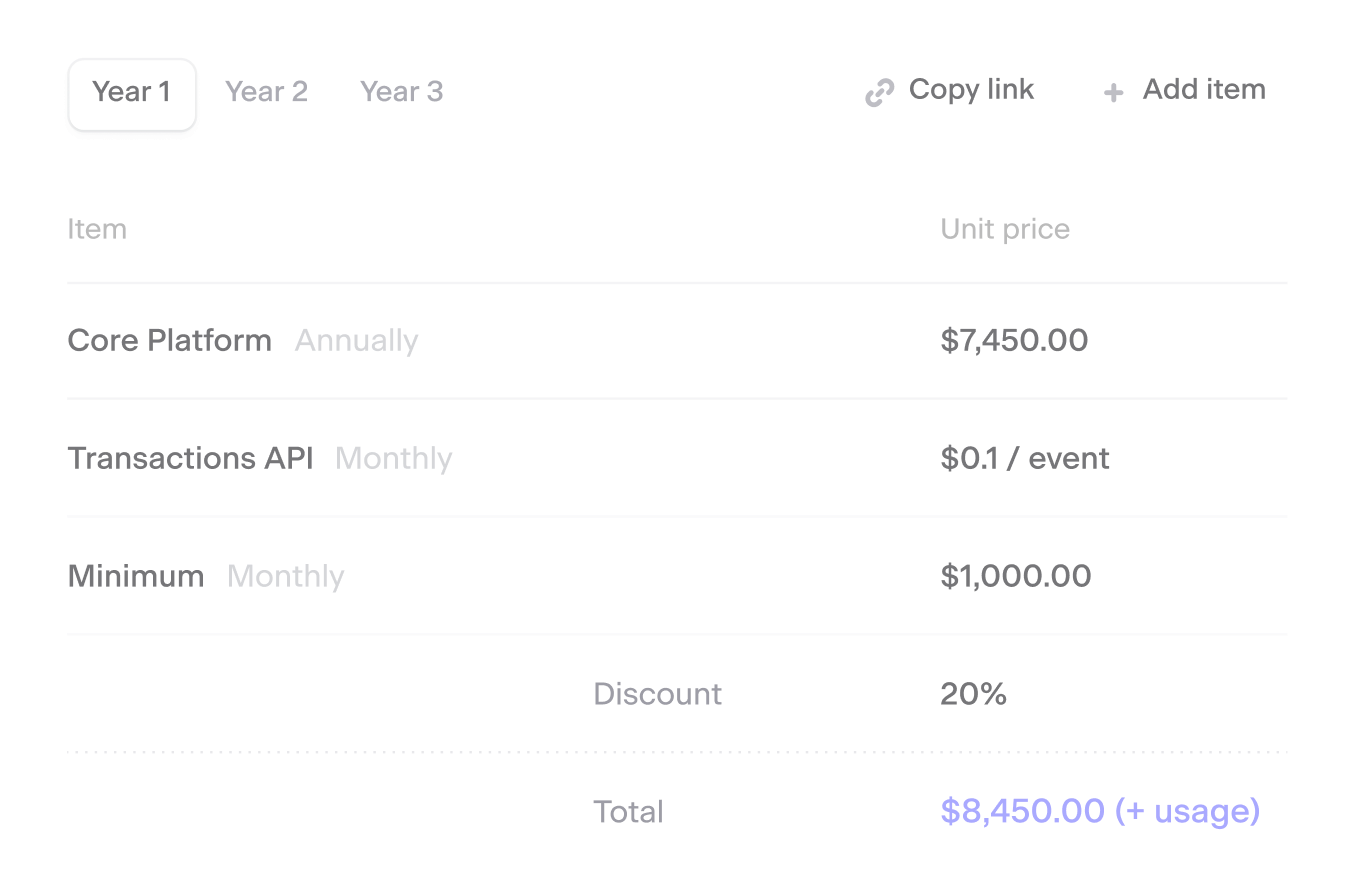

Accurate billing for complex, usage-based / custom contracts

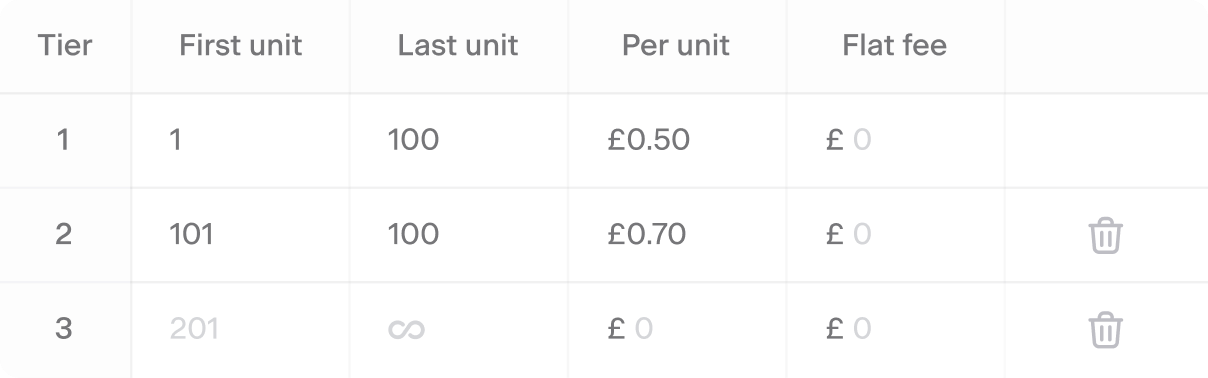

Complex mix of upfront subscription fees and usage based in-arrears charges. Each subscription includes over 40 usage-based products including tiered percentage and usage fees that varies for each customer depending on their plan. Sequence was able to seamlessly handle all pricing scenarios, resulting in a fully automated billing workflow with a 12% (and growing) reduction in revenue leakage since signing.

Deep integration with Sequence <> Snowflake <> QuickBooks

Weavr used to aggregate data themselves before sending it to Chargebee. Sequence takes care of this directly and allows Weavr to validate that all billing data is correct before being ingested by our usage API. Their invoicing data can now be exported directly from Sequence into Snowflake and on the QuickBooks (QBO) side, Weavr can now sync products at the line item level, map tax categories and handle FX conversions automatically when syncing transactions between Sequence and QBO.

Get in touch to book a Sequence demo.

Tech Stack Overview

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories