$200k

Increased revenue capture in the first two quarters of using Sequence.80%

Reduction in quarterly invoicing time in Q3 20250.7%

Removed from COGS previously paid in Stripe Billing feesSchedule your demo and get started in hours.

I’ve been pushing to move away from Stripe Billing for a long time. We evaluated other billing and contract-to-cash platforms, but none of them offered the billing flexibility required for our complex contract terms or the polished quoting experience for our growing sales team.

Billy Motherway, Revenue Operations Manager @ Arch

Arch is a digital platform for tracking private market investments, consolidating fund data, automating K‑1 collection and surfacing performance insights.

The Challenge

- Find Stripe Billing replacement that can track daily # of seats to instantly charge for upgrades, combining annual/semi-annual billing options with quarterly true-up charges

- All-in-one CPQ + billing platform to unify sales and finance teams in 1 place

- Facilitate Stripe payments for SMB customers and ACH payments for midmarket/enterprise customers

“I’ve been pushing to move away from Stripe Billing for a long time. We evaluated other billing and contract-to-cash platforms, but none of them offered the billing flexibility required for our complex contract terms or the polished quoting experience for our growing sales team.”

Billy Motherway (Revenue Operations Manager)

The Solution

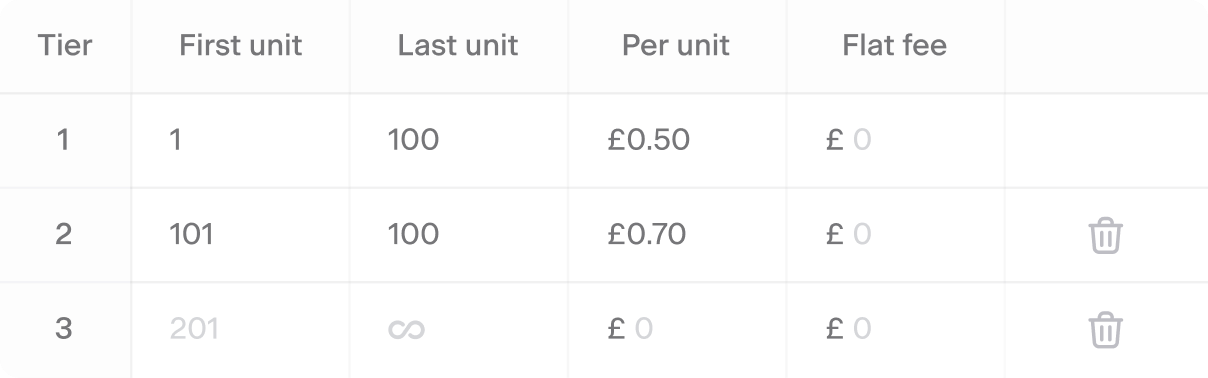

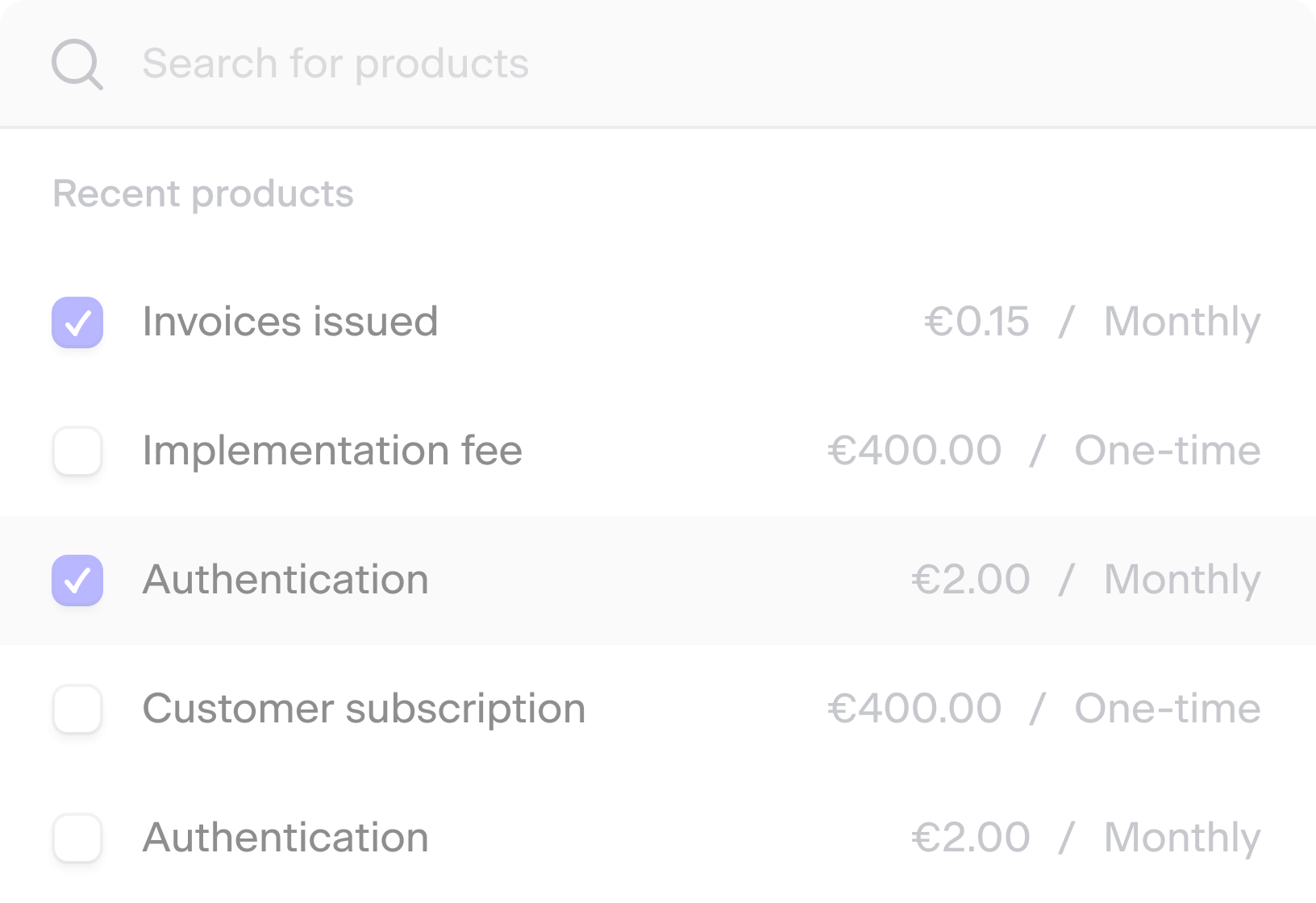

Best-in-class seat-based billing infrastructure

Arch, Incident.io, Attention and others have all transitioned from Stripe Billing to Sequence for this reason. Sequence has built the state-of-the-art billing infrastructure for seat-based pricing models. The real challenge lies in the edge cases— prorated overages, automated charges and credits for upgrades / downgrades and more. Arch leveraged our API to update seat balances daily, unlocking $200k in their first 3 months by capturing revenue that previously wasn’t possible.

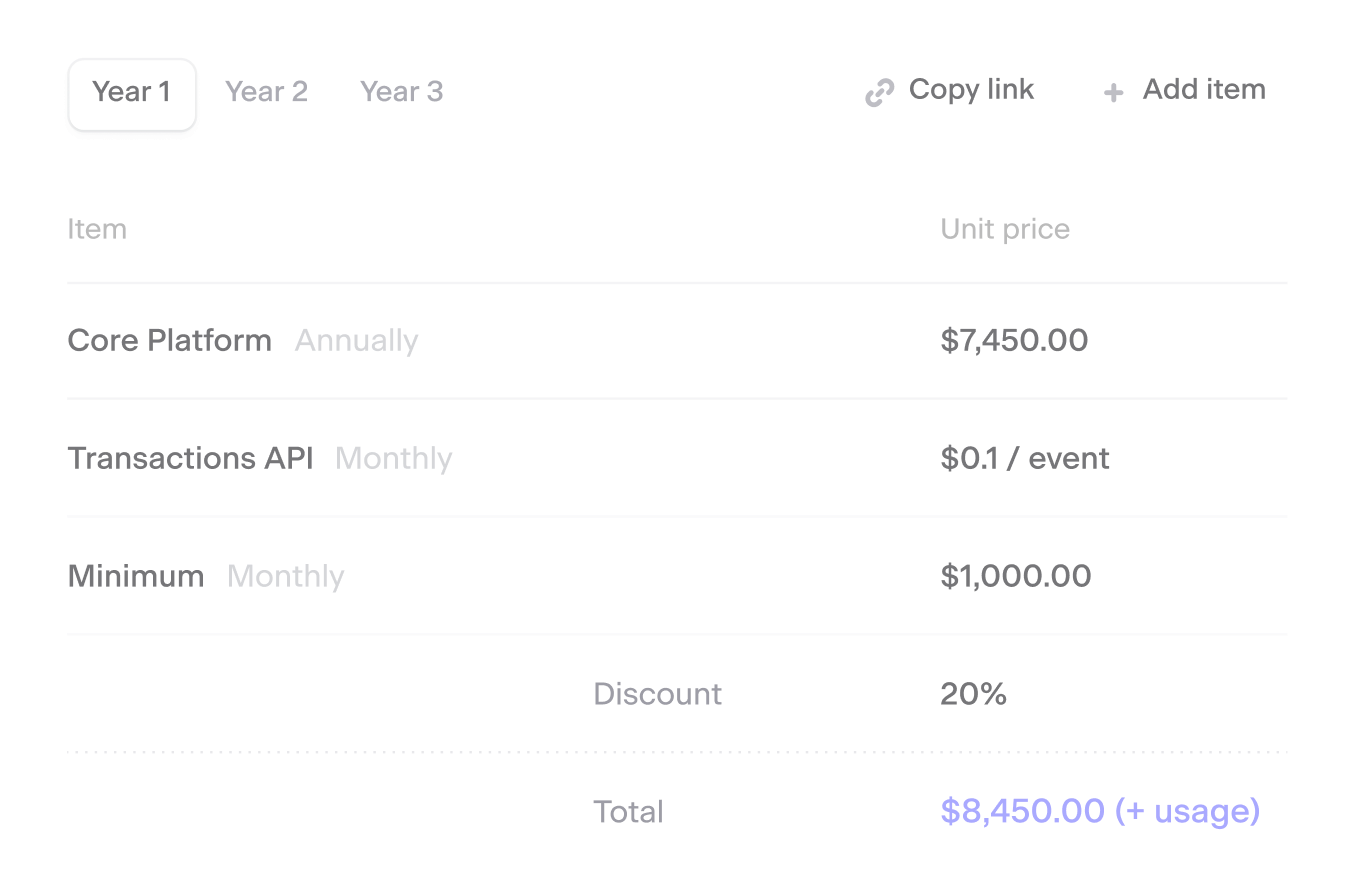

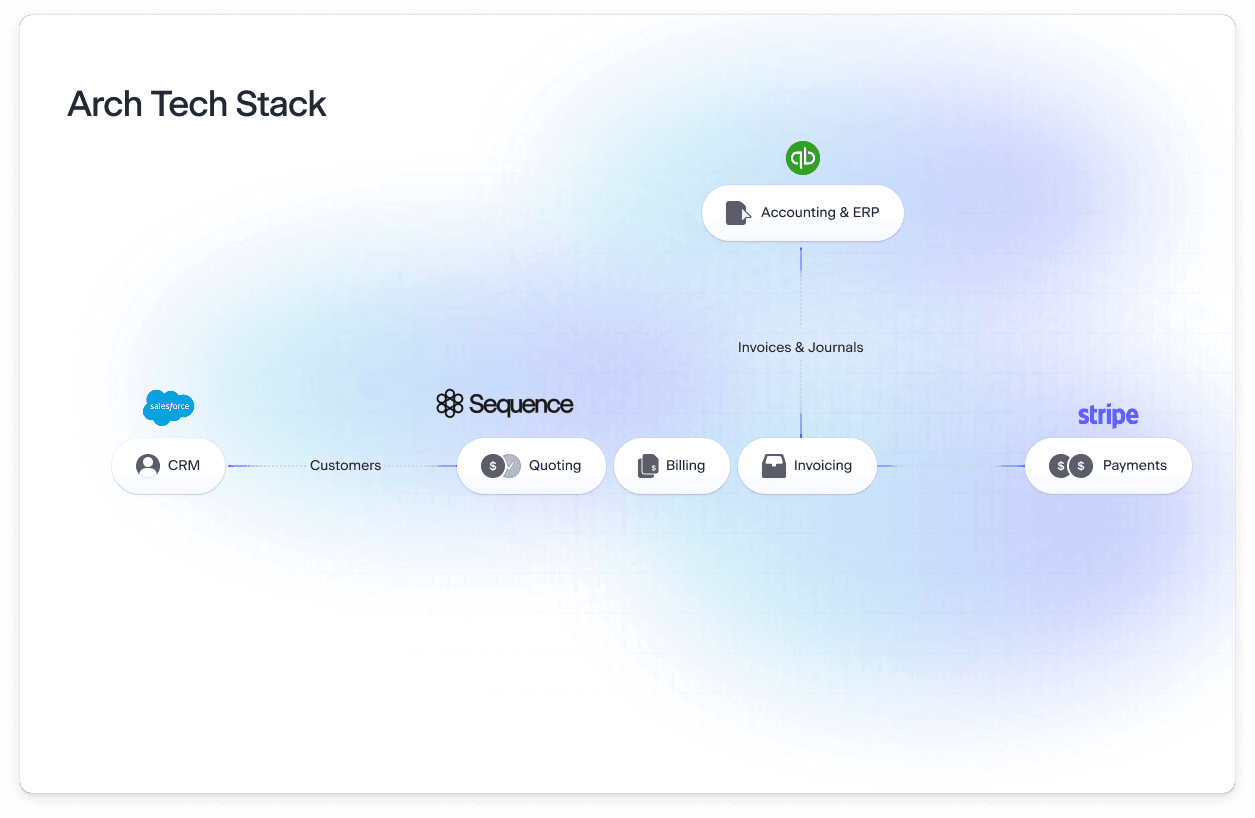

CPQ + Billing + Reporting. Sales + RevOps + Finance. 1 platform.

Arch is leveraging Sequence to the full extent. The Sequence e-signature module provides a frictionless signature experience, instantly converting signed quotes into active billing subscriptions. This enables an automated, watertight invoicing workflow for any pricing model. All of which ends up in a clean data export for reporting and commissioning at quarter end.

Complete customisability with customer payment options

Arch configures billing schedules with custom payment methods for each contract. Smaller customers pay via Stripe, but midmarket and enterprise customers use ACH to avoid the 2.7% card processing fees. Sequence’s flexible billing modules allow customers to define payment terms per contract.

Get in touch to book a Sequence demo.

Tech Stack Overview

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories