50%

Reduction in code required to calculate ARR.15-20%

Estimated reduction in the time spent setting up customer subscriptions.1000+

Customers automatically billed via SequenceSchedule your demo and get started in hours.

Stripe’s numerous limitations - most notably on the sales-serve side - were causing us issues across numerous key areas, and these issues were only set to increase as we continued to scale the company. We were understandably very cautious about replacing such a business-critical tool and as such we did a lot of testing in advance of agreeing to migrate Stripe data over to Sequence. The migration to Sequence has significantly increased the confidence levels across a range of key datapoints and we now have the revenue infrastructure in place to scale towards a 9 figure ARR in the coming years.

Alex Spink, VP of Finance @ incident.io

incident.io is the all-in-one AI platform for on-call, incident response, and status pages - built for fast-moving teams.

The Challenge

- Rip and replace 4 years of legacy Stripe code for 100s of customers, while seamlessly upselling self-serve customers onto custom contracts without breaking billing.

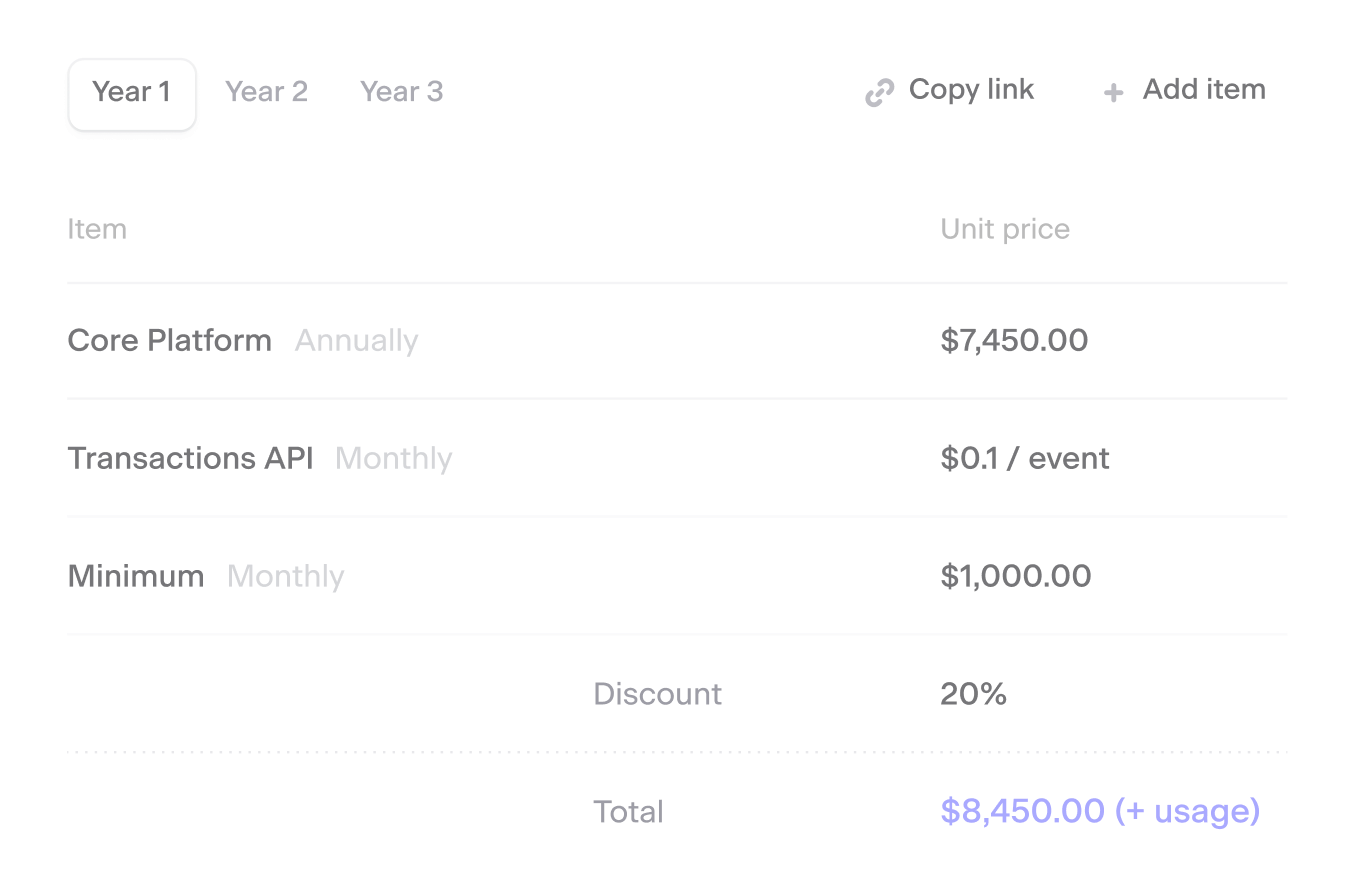

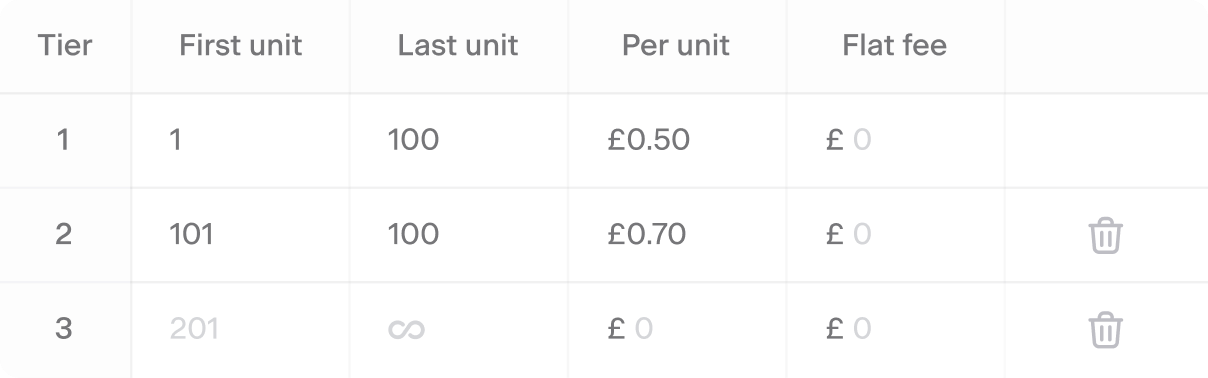

- Automate invoicing for complex, sales-led Enterprise contract edge cases; 12+ month contracts (with custom extension logic), free trials, automated overages / credits for instant revenue capture, custom discounts, tiered pricing and co-termed upsells.

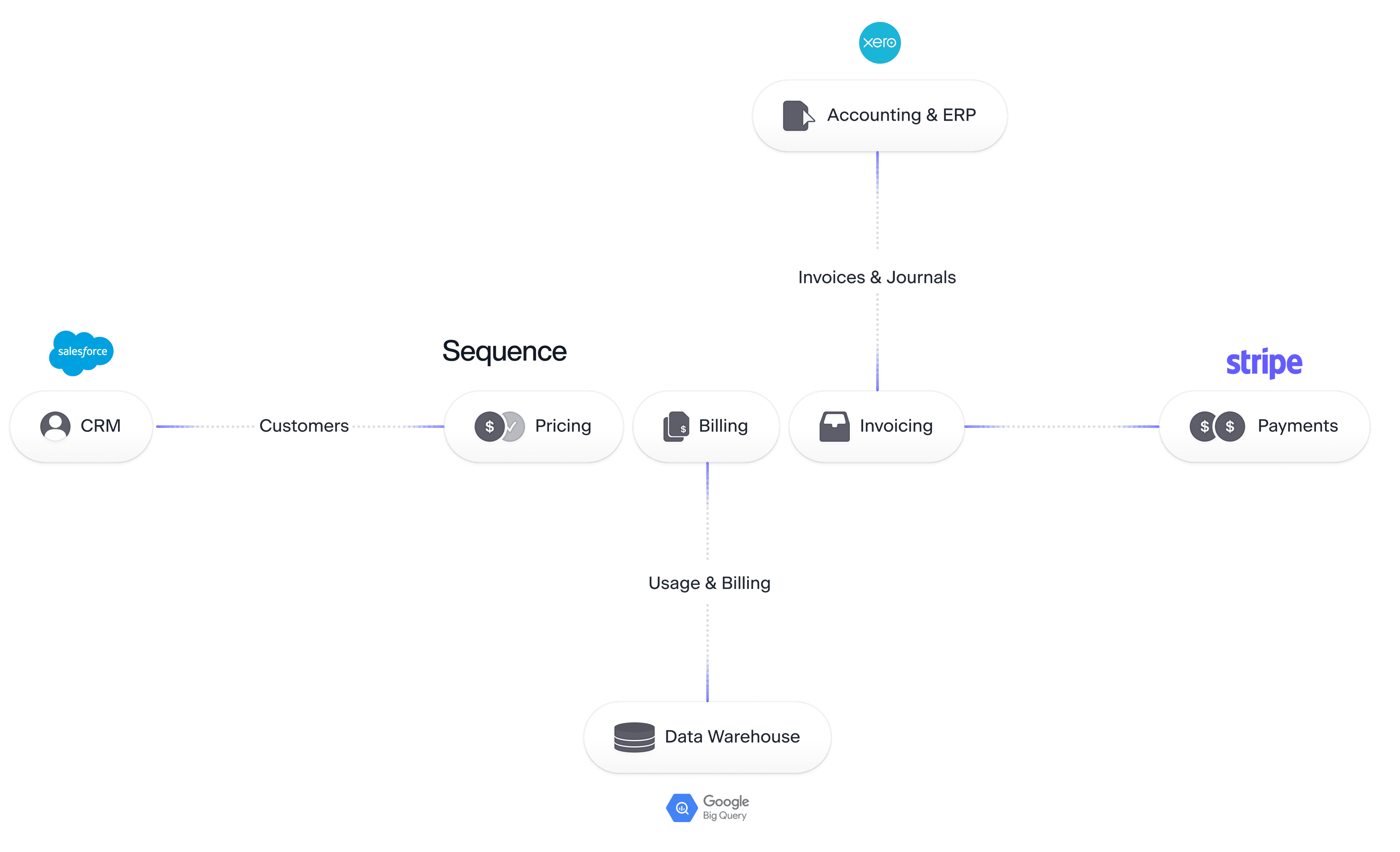

- Streamline Finance and Data operations onto 1 contract to cash platform, with robust integrations across the CRM (Salesforce), ERP (Xero) and data warehouse (Google BigQuery).

“For a long time we were without an in-house Finance team and billing was secondary to closing deals. Stripe’s limitations meant that we were constantly having to do manual workarounds to avoid errors in key areas such as invoicing and revenue recognition. As the incoming Finance team it was therefore a key priority to be able to eloquently handle today’s unusual/complex scenarios as well as tomorrow’s, and to reduce the time required to get our customers provisioned. Sequence has therefore contributed to both happier customers and saved time within a busy Finance team.”

Jack Bridge (Management Accountant)

The Solution

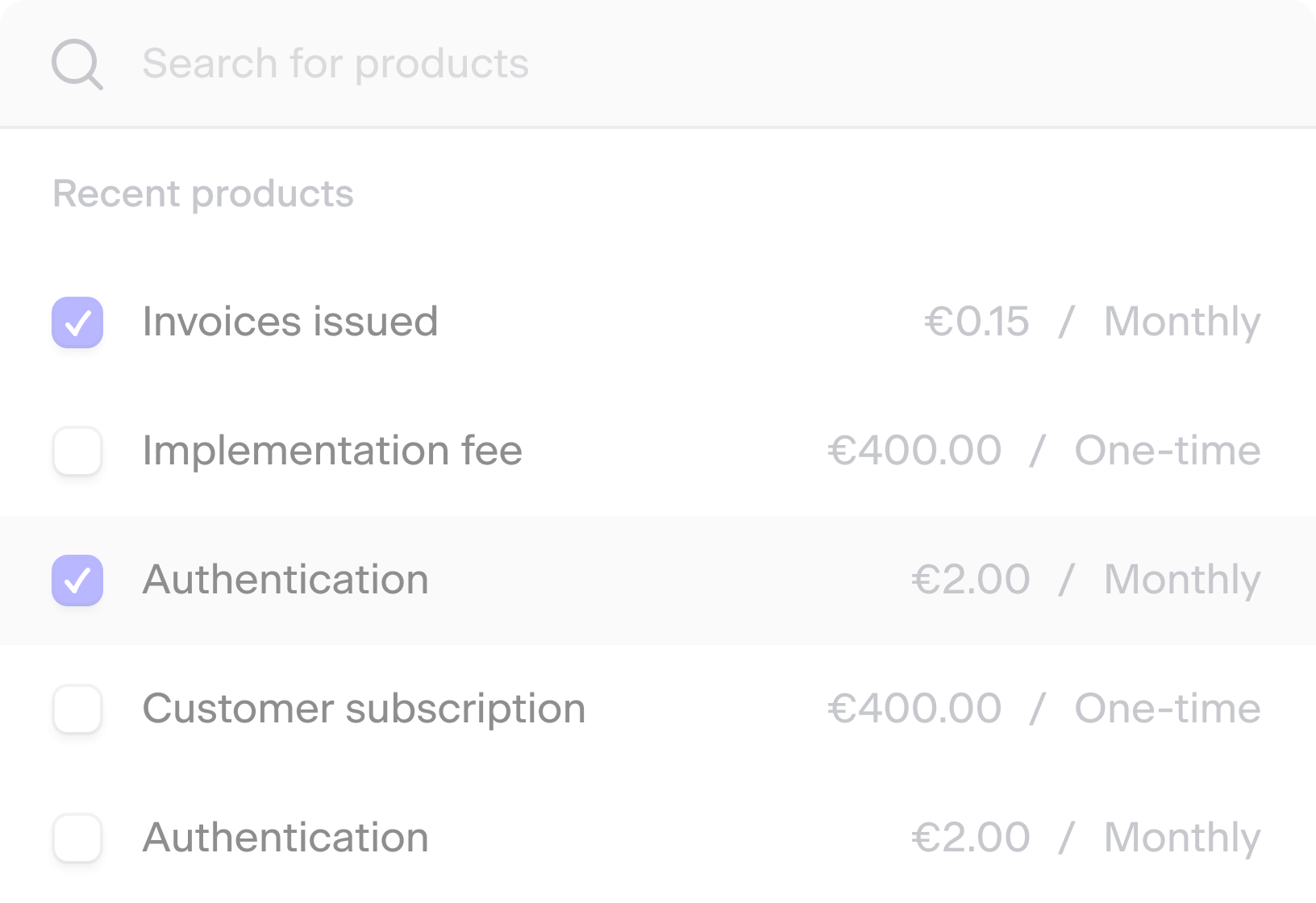

A rip & replace of Stripe Billing for 1000+ customers

With the direct support of Sequence’s engineering team in a shared slack channel and a dedicated Stripe migration manager, incident.io was able to successfully migrate 1000+ customers over to Sequence.

The peace of mind that any enterprise contract term can be invoiced accurately

incident.io’s strong momentum in the enterprise space has resulted in a large number of custom contracts with advanced edge cases that required constant manual adjustments in Stripe, e.g. to prorate overage charges for any mid-cycle seat additions, issue a credit note for any downgrades, free service periods for single or multiple products, 12+ month contracts and co-termed upsells. Sequence has been able to manage all contract types thus far which represents a significant step forward vs Stripe.

1 scalable revenue platform for the journey to $100m ARR for PLG + sales-led billing and reporting

The efforts of incident.io switching from Stripe to Sequence have been rewarded by having 1 core platform to support all contract, billing and reporting workflows, with robust integrations across Salesforce, Xero and Google BigQuery. incident.io now has a more robust ARR reporting pipeline, including the ability to tag mid-cycle upgrades to cleanly include/exclude from ARR calculations as appropriate. incident.io can now easily transition any self-serve customers into custom, sales-led contracts, without breaking the invoicing process.

"Nice stat so far: it takes ~half the lines of code to calculate ARR using Sequence data vs. Stripe (~300 lines in Stripe SQL models specifically to calculate ARR, and around 150-200 to do the same in Sequence), and with Sequence we can do it with 1 table, whereas with Stripe we needed ~10 tables. The Sequence code is also far cleaner comparatively as a result."

Jack Colsey (Analytics Manager)

Curious to learn more about why modern B2B companies are moving from Stripe Billing to Sequence?

Get in touch to book a Sequence demo.

Tech Stack Overview

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories