4

systems consolidated replaced with Sequence88%

faster invoice creation95%

reduction in pricing configuration timeSchedule your demo and get started in hours.

"PandaDocs isn't a native invoicing system so we tried using Stripe Billing, but the two systems were disconnected. As our billing complexity increased, the total cost and operational overhead of our setup increased as well. ”Every time the sales team changed pricing, I had to spend 2-4 hours rebuilding the logic in our custom HubSpot calculator. Our finance team was delayed by two or three days just to send an invoice as we scaled."

Baiba Pumpure, Finance Operations

Filed is the intelligence layer that plugs into tax firms’ existing workflow to standardize binders, accelerate return preparation, review human-prepared work for issues and omissions, and generate advisory insights—without disrupting the tax software teams already rely on.

As Filed's sales team closed increasingly complex deals, their quote-to-cash infrastructure broke down. Stripe Billing introduced material billing fees on invoiced revenue while Panda docs contracts couldn't be properly mapped into Stripe for automated billing.. With finance manually creating invoices and systems creating incorrect deal stages in HubSpot, Filed needed a billing and quote to cash platform built for B2B complexity. Sequence delivered a complete solution in under 4 weeks.

The Challenge

- Quote and contract terms lived in one system; billing lived in another—creating manual handoffs.

- Credits-based usage billing required more flexible configuration and better internal ownership.

- Invoicing and accounting sync required manual cleanup to keep systems consistent.

"PandaDocs isn't a native invoicing system so we tried using Stripe Billing, but the two systems were disconnected. As our billing complexity increased, the total cost and operational overhead of our setup increased as well. ”Every time the sales team changed pricing, I had to spend 2-4 hours rebuilding the logic in our custom HubSpot calculator. Our finance team was delayed by two or three days just to send an invoice as we scaled."

Baiba Pumpure (Finance Operations)

The Solution

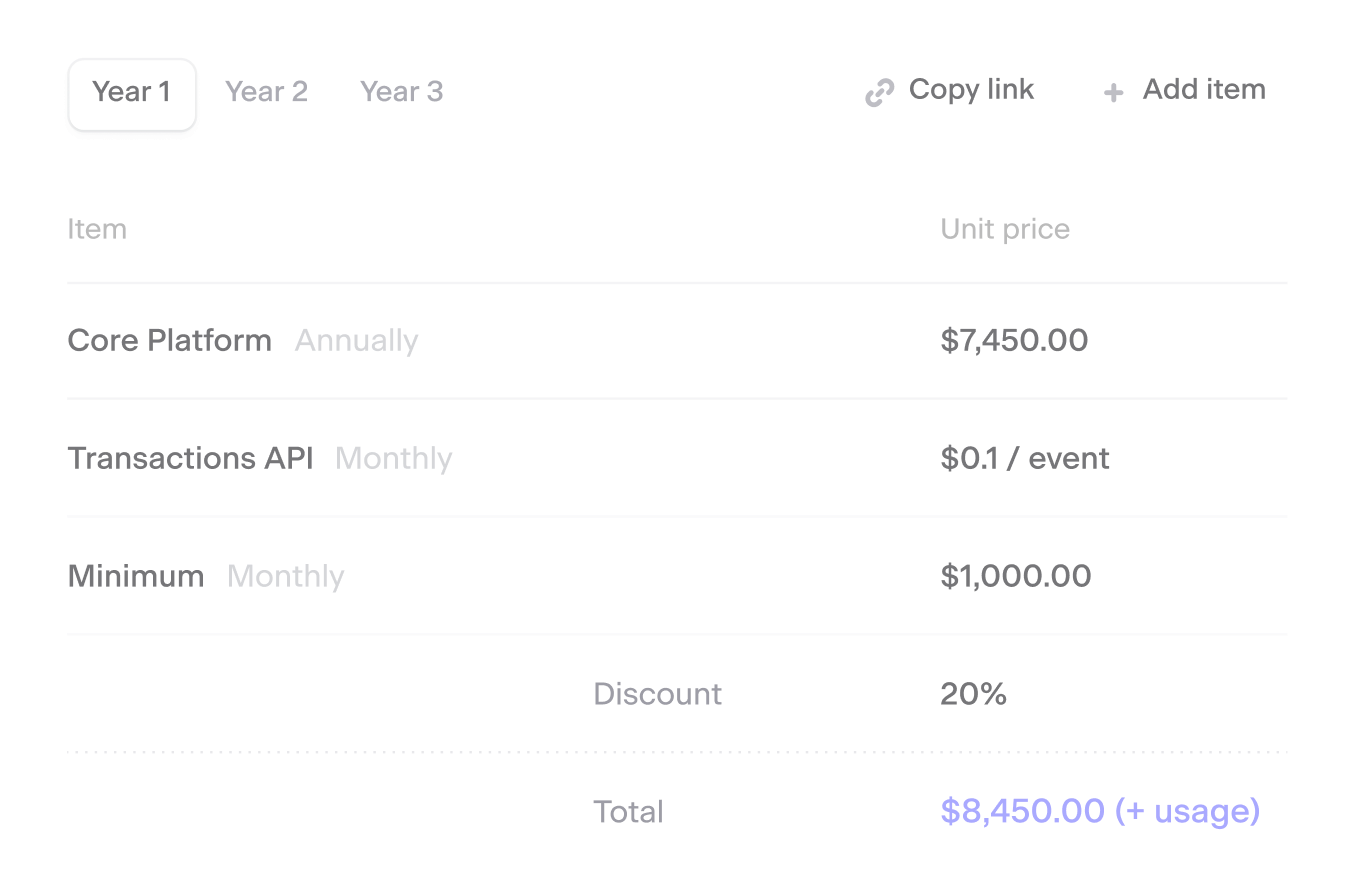

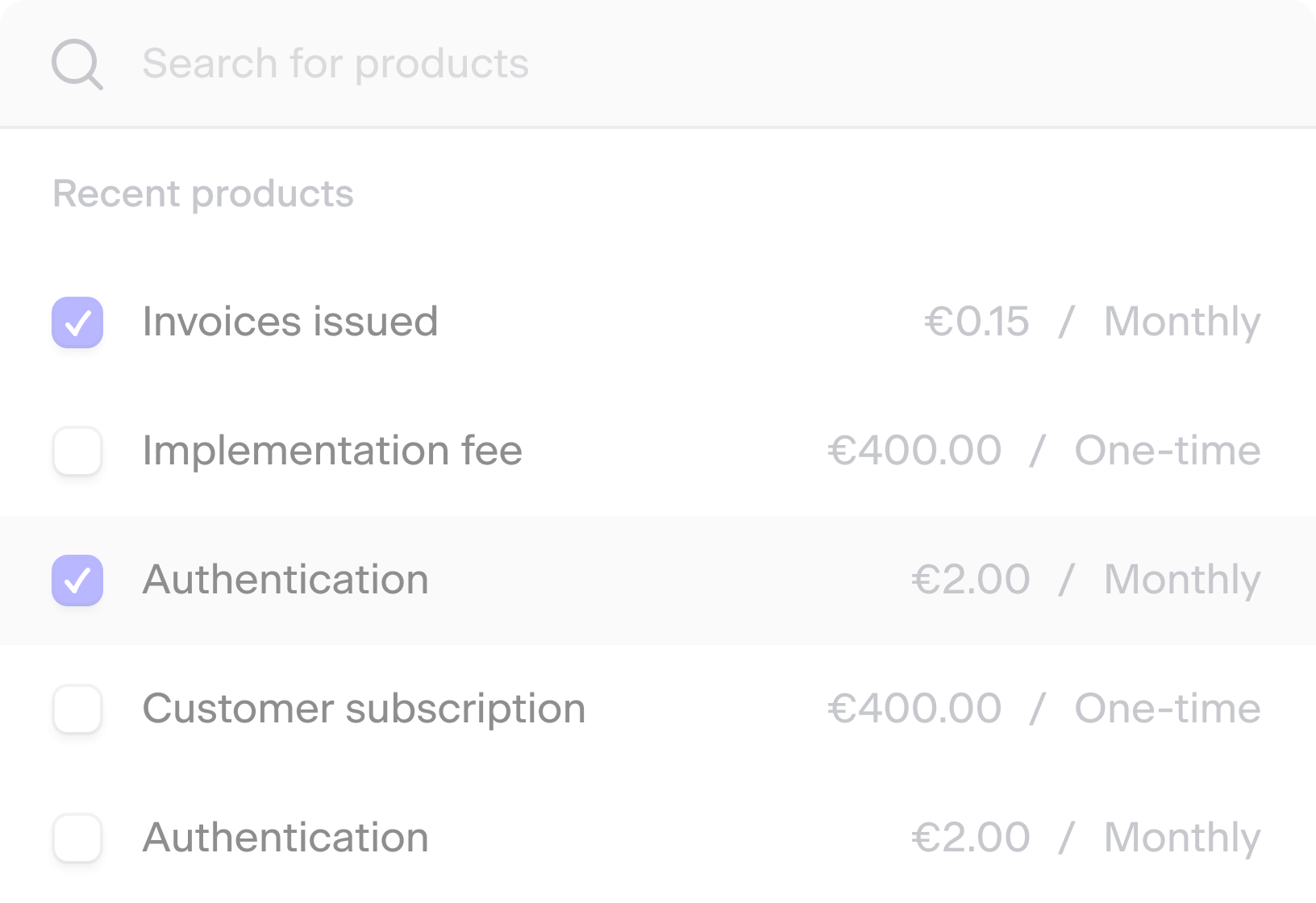

Native CPQ with flexible pricing configuration

Sequence replaced Filed's custom HubSpot calculator with a CPQ module purpose-built for complex pricing. Sales reps now configure multi-year contracts with phase-based discounts, credits-based, complexity-weighted pricing, and custom deal structures directly in Sequence without developer involvement. The platform handles double-discount scenarios where customers receive both free usage credits and percentage discounts layered on top. Pricing changes that previously required 2-4 hours of development work now take minutes.

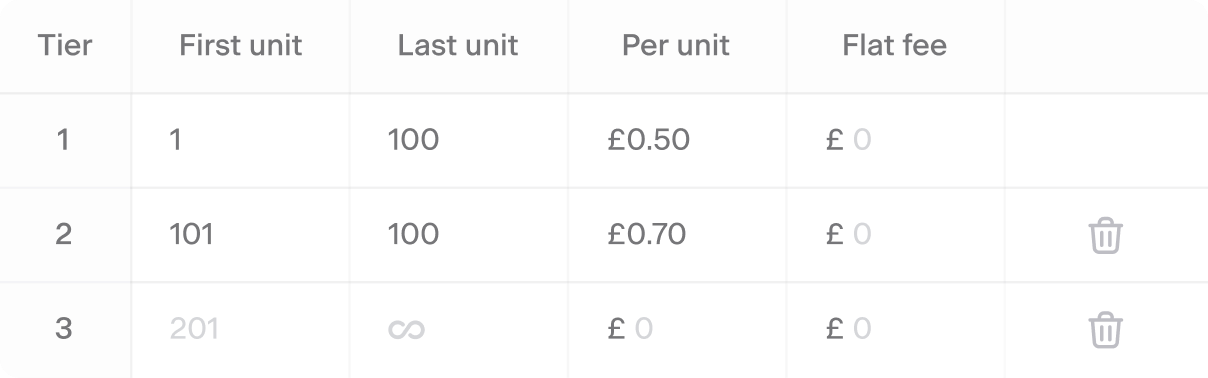

Automated usage-based billing with credits system

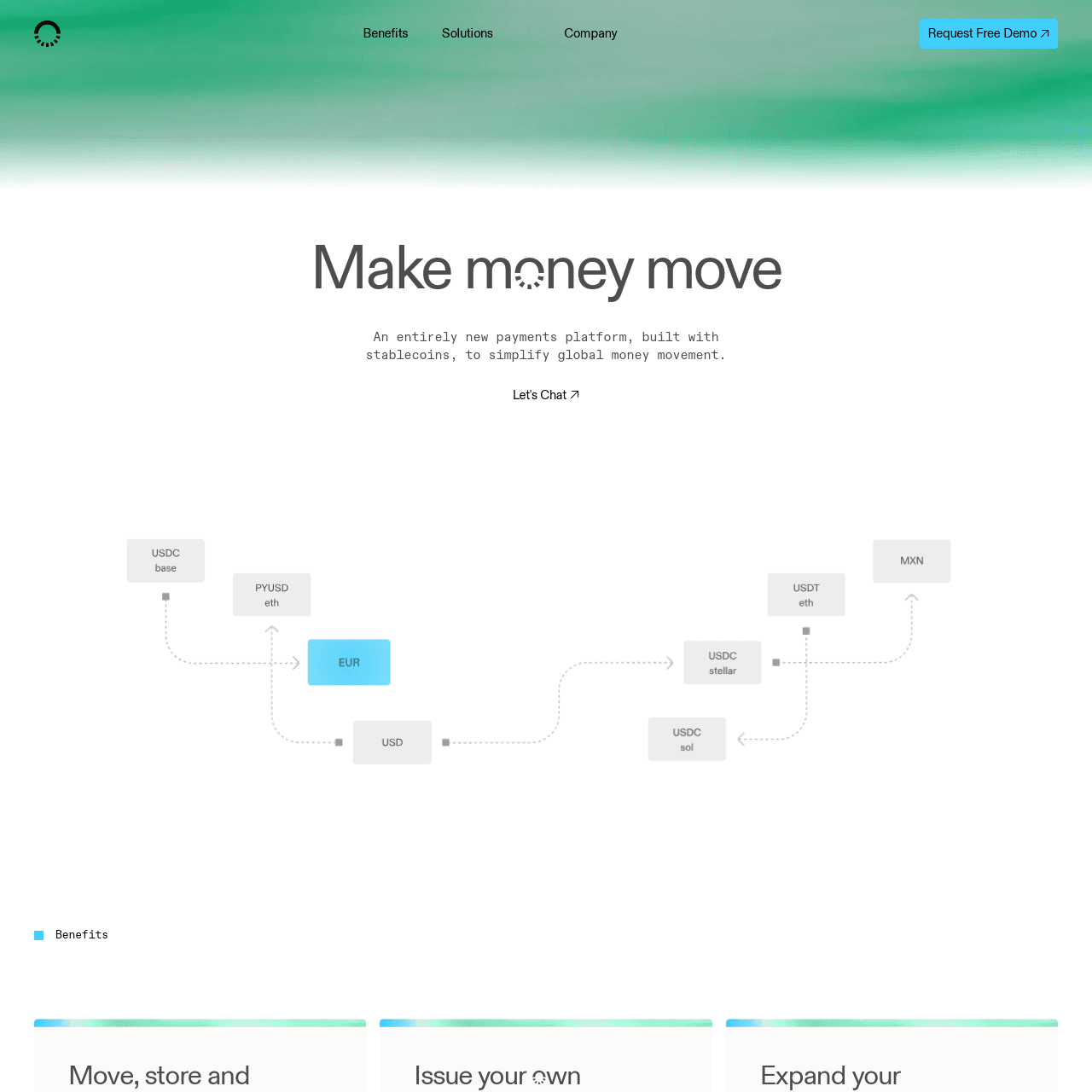

Sequence's usage metering handles Filed's per-return pricing model and credit grants for trial users. Customers can pre-purchase credit bundles or receive recurring monthly credits that automatically bill down as tax returns are filed. The platform supports both one-time credit purchases and recurring monthly allocations, with the flexibility to adjust credit amounts on monthly or yearly billing cycles. Usage events stream directly into Sequence via API, eliminating manual billing calculations. Native Avalara integration automates sales tax calculations across all US jurisdictions, critical for a tax filing platform serving customers nationwide.

Managed Stripe migration with two-way integrations

Sequence's migration team recreated all existing subscriptions from Stripe Billing in under 2 weeks, reducing the billing fee while preserving payment methods so customers continued using Stripe checkout without disruption. Customer data automatically syncs from HubSpot into Sequence, while all contract and billing information syncs back to HubSpot deal records. Invoices automatically flow into QuickBooks with proper invoice numbers, due dates and account information that PandaDocs couldn't provide. Sequence created a unified revenue workflow connecting HubSpot, Sequence and QuickBooks with Avalara handling sales tax calculations automatically

"Sales can now configure any pricing model without needing me to spend hours rebuilding calculators. The system handles our complex tax return pricing, credit bundles and multi-year discounts automatically. We eliminated the Stripe Billing fee and now have a quote-to-cash workflow better aligned with our sales complexity and credits-based billing model.We have proper invoice numbering and accounting integration working seamlessly."

Baiba Pumpure (Finance Operations)

Book a demo here

Tech Stack Overview

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories