Donal McKeon

Top 7 AI Tax Software for Finance and RevOps Teams

Today’s scaling SaaS companies are dealing with sales tax thresholds in the US, VAT requirements across Europe, and digital services taxes cropping up everywhere. The traditional way of managing indirect tax—spreadsheets and manual filing-–doesn’t hold up to this complexity. AI tax software is changing that. These programs don’t just calculate the right amount of sales tax or VAT to collect, they predict where your business will trigger nexus, take care of tax filing and payment, and handle cross-border compliance without manual work. These AI-powered tools are a fit for every tax use case.

Why AI Tax Software Is on Every Finance Leader’s Radar

Compliance Complexity is Scaling Faster than Teams

Governments around the world are getting serious about tax enforcement. In the US, economic nexus laws mean you may need to collect sales tax in Michigan after just 200 transactions. New EU VAT rules require you to track where your customers actually use your service, not just where they're based. And real-time tax reporting is already mandatory in countries like Italy and Brazil, with others following hot on their heels.

Manual processes can’t keep up. And that’s before adding in multiple states and international complexity. Tax compliance is a growth killer. You’re either forced to add more heads, slow down growth, or risk non-compliance and the fines and penalties that entails.

AI is Changing Tax Workflows

AI-powered platforms allow your business to keep up with the new rules and requirements without working your finance team on weekends. They know that your SaaS product is taxable in Tennessee but not in California. They categorize transactions, predict when you'll hit nexus thresholds, and even prepare filings before deadlines approach. What was once manual work becomes automated workflows.

Best AI Tax Software Solutions

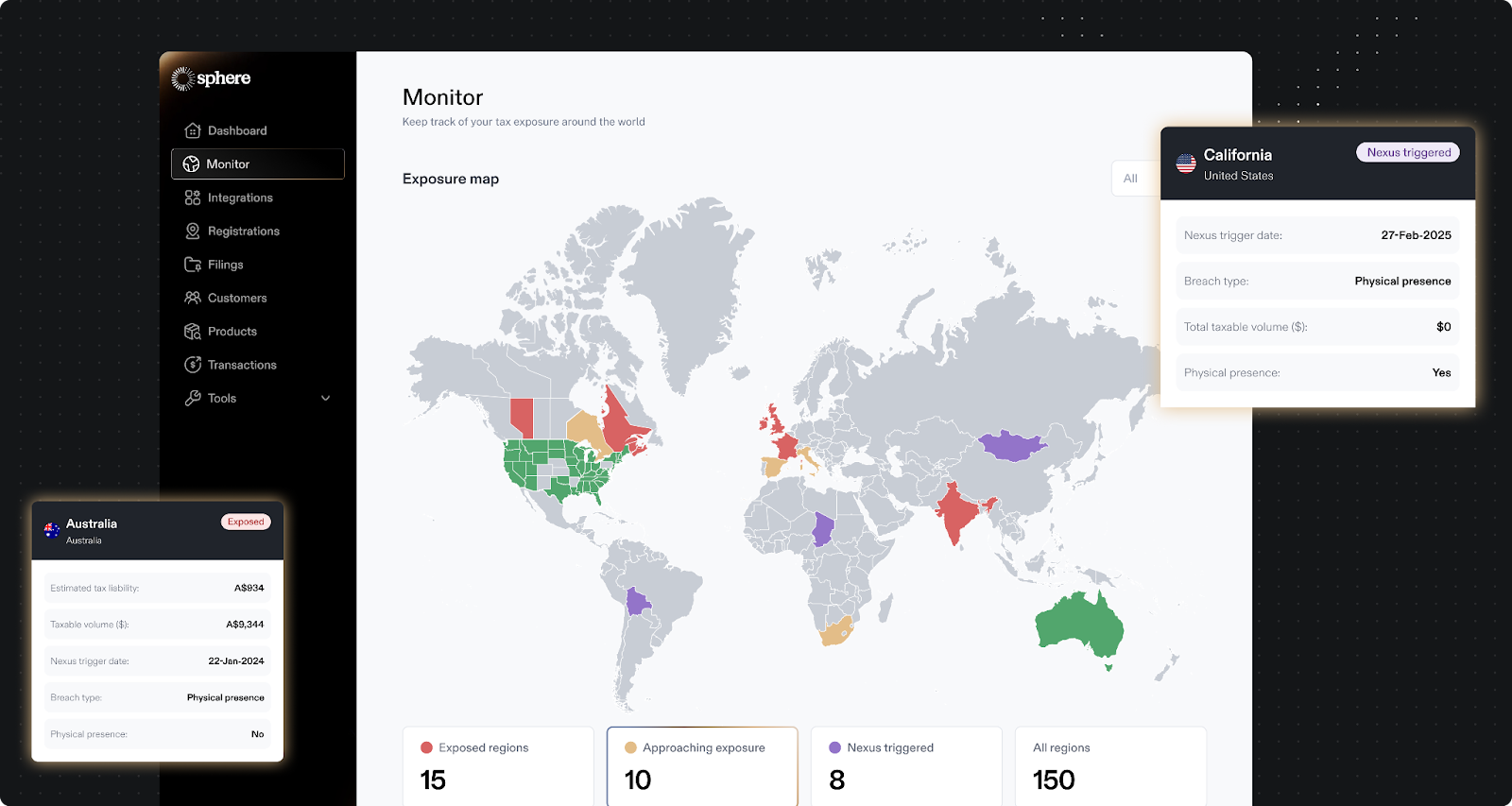

Sphere is the go-to solution for SaaS and AI companies operating internationally. Unlike legacy solutions with cobbled-together international support through third-party networks, Sphere built global coverage from day one.

Their Tax Review and Assessment Model (TRAM) engine sets Sphere apart. It’s a fine-tuned LLM trained specifically on tax law that automatically determines taxability across every jurisdiction. It covers everything from sales tax in Texas, to VAT in Ireland, to Japan’s JCT. Sphere also integrates with taxing authorities worldwide to file and pay, meaning no extra complexity or cost.

Pricing is refreshingly simple at just $100 per month per jurisdiction. There are no overage charges, no transaction fees, and no multi-year contracts. Companies like Deel, Granola, Linktree, Lovable, and Fyxer.ai use Sphere because it handles their entire global tax footprint in one modern platform.

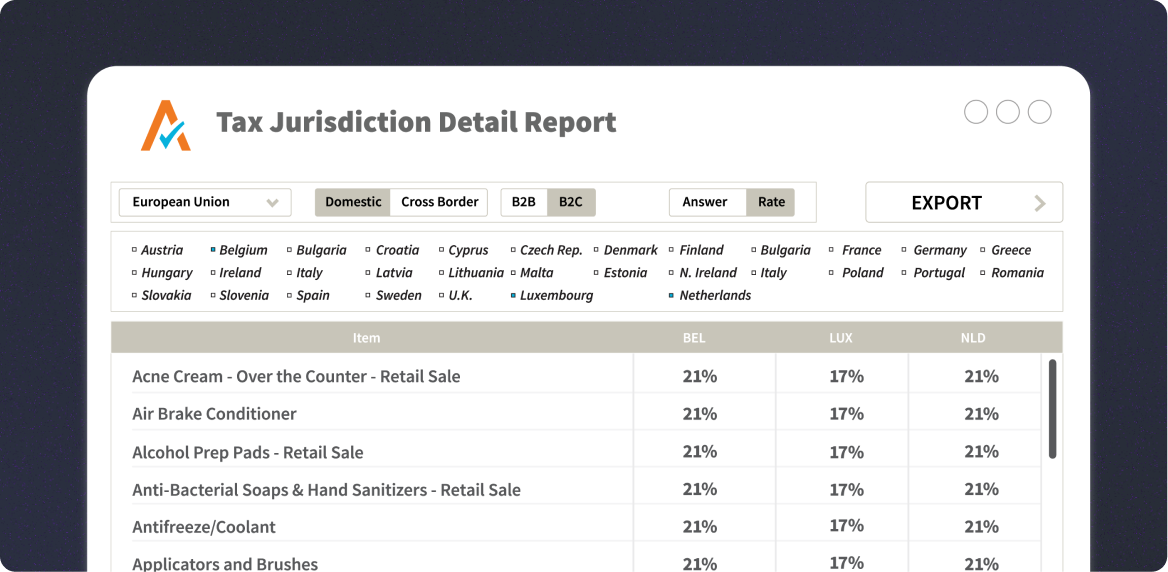

For Enterprise-Scale Indirect Tax Infrastructure – Avalara

Avalara is the legacy solution still used by many large enterprises. It offers broad indirect tax coverage through partner networks and handles complex exemption certificate management well.

The platform works best for companies with established tax teams that need deep configurability. It’s particularly strong for businesses with physical products that need to manage exemptions and special tax rules. The downside? Implementation can take months, and pricing gets complex with customers complaining of hidden transaction fees and overage charges.

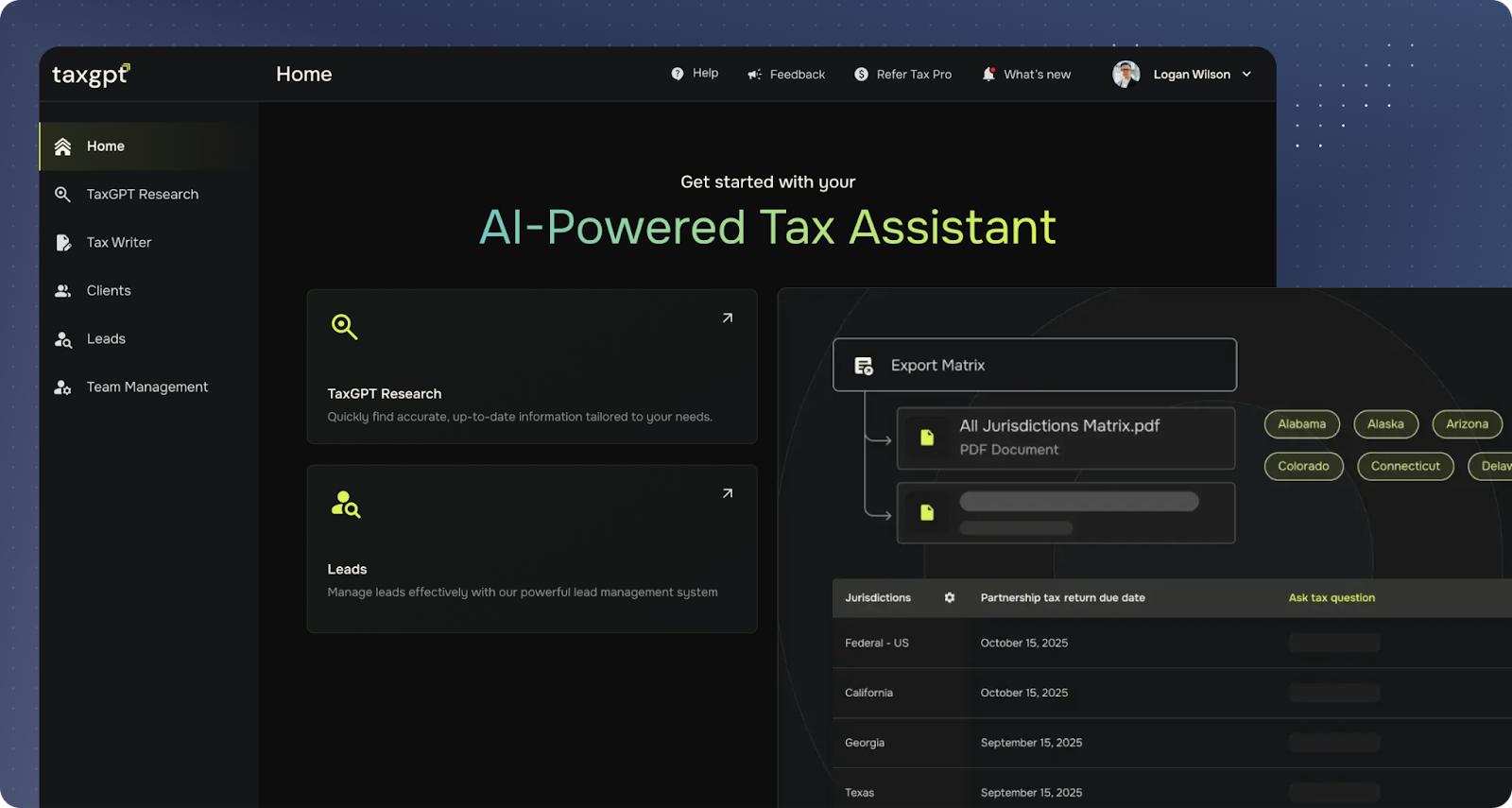

For Tax Research and Documentation – TaxGPT

TaxGPT is an LLM trained on IRS bulletins and the complete US tax code. It’s essentially a research assistant for tax professionals and RevOps teams who need to validate positions or investigate edge cases.

Their platform provides responses with citations, which is vital for audit-readiness. For example, if you’re trying to determine if your business qualifies for a tax credit, TaxGPT pulls the relevant code sections and revenue rulings. This tax assistant is ideal for firms or tax teams doing in-house research or quality assurance on tax return filings.

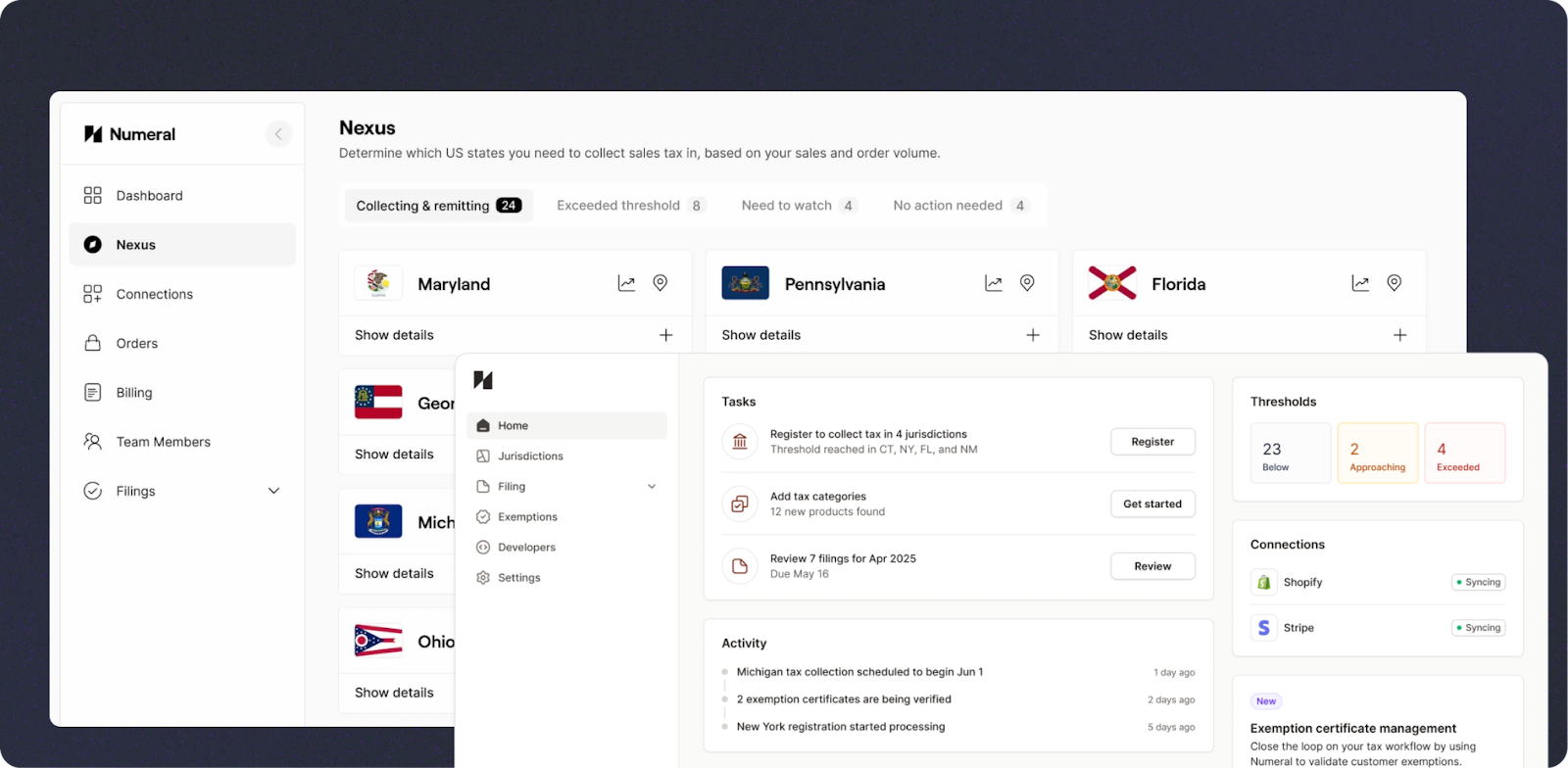

For Automated Finance Operations & Revenue Tax Compliance – Numeral

Numeral takes a different approach by embedding tax compliance directly into revenue workflows. Built first for e-commerce companies, it unifies payments, revenue operations, and tax compliance all in one streamlined system.

The platform automates US sales tax rules inside your existing workflows. It integrates with Billing systems like Sequence, and your ERP to sync transactions and route taxes accurately. This reduces manual reconciliation significantly. Pricing is customized based on transaction volume rather than flat fees.

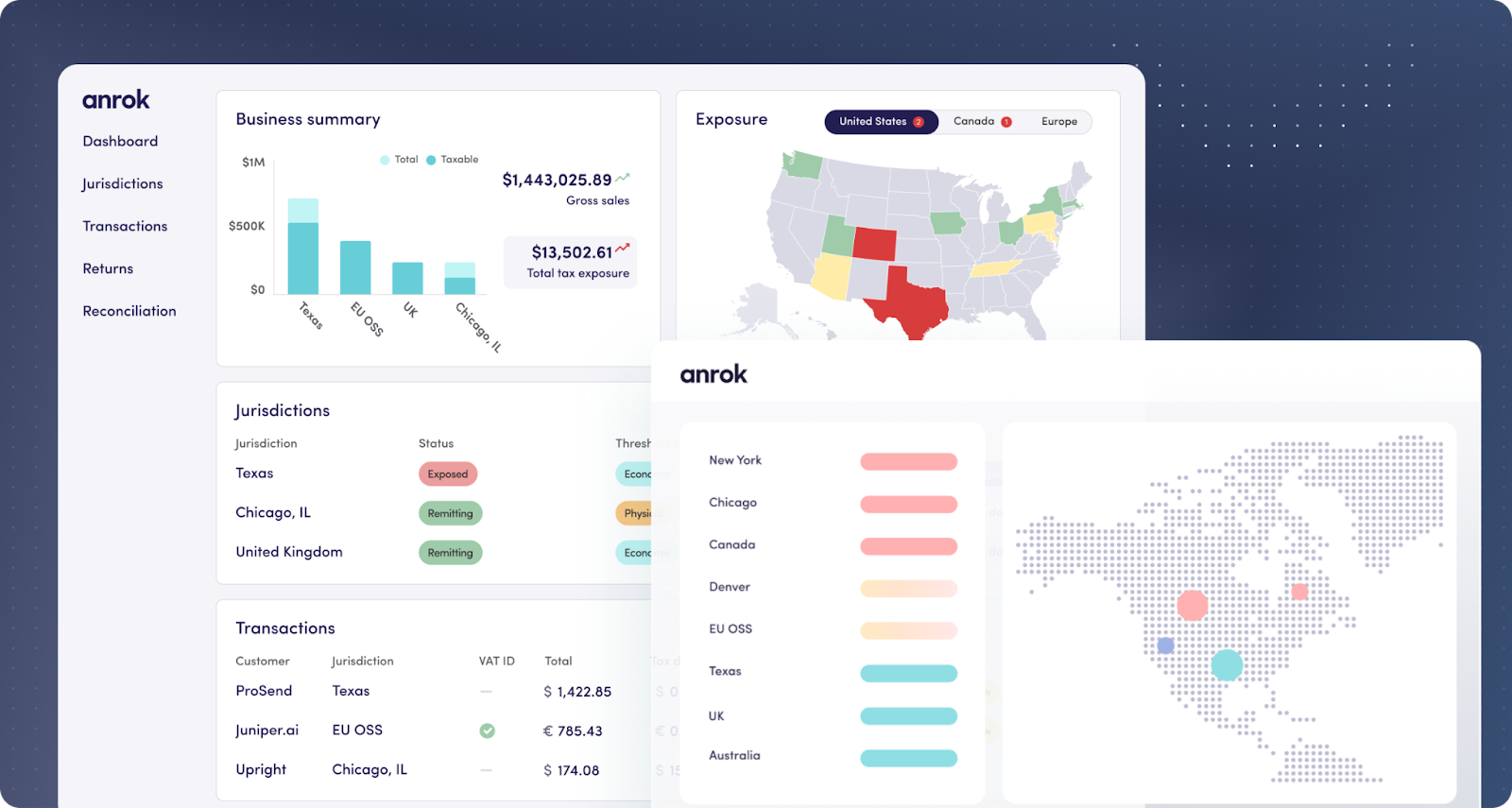

For Domestic SaaS Tax Automation – Anrok

Anrok focuses primarily on US sales tax for SaaS and AI companies. It’s built for businesses that sell primarily to US customers and need to manage state sales tax compliance.

The platform handles nexus monitoring and automates filings across states. Pricing includes monthly platform fees plus revenue-based transaction costs. It’s a solid choice if you’re a US-only business, but you’ll need a different solution when you expand across borders.

What to Keep in Mind When Choosing the Right Platform

Match the Tool to Your Complexity

Basic filers with simple domestic needs can use consumer-grade tools. But if you’re selling software across multiple states or countries, you need a platform built for that complexity.

Multi-country SaaS companies need platforms like Sphere that understand the nuances of digital product taxation across borders. A tool that works great for physical products might completely mishandle complex SaaS taxability.

Look for True AI Infrastructure, Not Just a Chatbot

There’s a vast difference between artificial intelligence copilots and system-native AI. TaxGPT is a copilot. It helps you research but doesn’t automate your workflows. Sphere’s TRAM engine is system-native, meaning it makes tax determinations automatically without human intervention.

Ask vendors where automation actually happens. Does the AI just suggest tax codes, or does it actually apply them? Can it file returns autonomously, or does it just prepare drafts?

Consider Support, Filing, and Pricing Models

Legacy pricing models don’t scale well in today’s SaaS and AI business climate. Per-transaction fees mean your compliance costs grow with revenue, which doesn’t make sense. Look for transparent, predictable pricing like Sphere’s flat per-region model.

Support matters too. When you have a tax question, you can’t wait 24 hours for a response. Check response times and whether you get access to actual tax experts, not just technical support.

Keep in Mind Broader Revenue Ops Needs When Making a Choice

Tax compliance doesn't exist in isolation. It’s part of your broader revenue operations stack. Some companies benefit from pairing tax tools with platforms that handle the entire quote-to-cash workflow.

Sequence, for example, automates pricing, quoting, and revenue workflows. It’s built to work alongside tax engines, creating a modern finance stack where data flows seamlessly from sale to filing. This integration eliminates the manual work that typically happens between systems.

The Bottom Line: AI Tax Software Is Finally Worth the Hype

AI tax platforms are no longer simplifying tax busywork, they’re eliminating it entirely. Real time nexus tracking means now more surprise registrations. Automated taxability determinations mean no more guessing whether your product is taxable in a new market. Document classification and filing automation mean your team focuses on strategy, not mind-numbing data entry.

The shift is particularly dramatic for companies operating across borders. What used to require separate solutions for US sales tax, European VAT, and other international taxes can now be handled in a single platform. The complexity that once limited international expansion is disappearing.

For businesses planning international growth, modern AI-native compliance engines make expansion feasible in ways it wasn't before. The manual work that used to scale linearly with growth is being automated away. Finance teams can support 10x the transaction volume with the same headcount.

The right platform depends on your specific needs, but the direction is clear: AI is making tax compliance a solved problem for modern businesses.

Donal McKeon

Related articles

How airCFO helps startups build scalable back office operations: Lessons from 200+ early-stage companies

Most founders treat their back office as an operational necessity. Alex Wittenberg and his team at airCFO turn it into a competitive advantage. After supporting 200+ early-stage VC-backed startups, airCFO has identified the patterns that separate companies with scalable financial operations from those constantly fighting fires. We spoke with Alex about the mistakes that create operational debt, the tooling decisions that matter at each stage, and how AI is changing what finance teams actually do.

Enda Cahill

The Fractional Finance Playbook: Lessons from 20+ Years of Scaling Startups

Frank Mastronuzzi has guided hundreds of fast-growing companies through their most critical financial decisions at Punch. His firm focuses exclusively on helping AI and SaaS companies navigate from zero to $100M ARR, with deep expertise in the specific challenges that emerge at each growth stage.

Enda Cahill

24 Years at Armanino: Building Scalable Finance Teams

Dean Quiambao has watched Armanino grow from 80 people to 3,000 employees during his 24 years at the firm. During this time, he has guided 100s of venture-backed companies through their most critical growth stages. Here are his highlight takeaways.

Enda Cahill