Merlin Kafka

Launching Sequence Revenue Recognition

Complex accounting, made simple. Streamline your month-end close with automated journal reports, aligned with your process. ASC 606 and IFRS 15 compliant.

Revenue recognition has always been the trickiest part of the finance stack. While billing automation has solved the "when to charge customers" problem, recognizing that revenue correctly in your books remains a manual, error-prone process that consumes days of finance team time every month.

Today, we're excited to launch Sequence Revenue Recognition in beta – purpose-built for modern B2B SaaS companies with usage-based pricing, custom contracts, and complex deal terms.

The problem with manual revenue recognition

Finance teams at growing SaaS companies spend countless hours each month creating journal entries manually. Here's what we consistently hear:

"Our month-end close takes forever" – Finance teams manually calculate journal postings for hundreds of contracts with different terms, billing schedules, and pricing models.

"We're always worried about compliance" – ASC 606 and IFRS 15 requirements are complex, and manual processes introduce audit risk.

"Our billing system doesn't handle recognition" – Most billing platforms focus on invoicing but leave revenue recognition as an afterthought.

"We can't scale our current process" – What works for 50 customers breaks down at 500.

Revenue recognition, designed for modern pricing

Sequence Revenue Recognition isn't just another accounting module bolted onto a billing system. It's built from the ground up to handle the complexity of modern B2B SaaS pricing.

Flexible recognition methods:

- Straight-line: Perfect for subscriptions and fixed-term contracts

- Usage-based: Recognize revenue as customers consume your service

- Point-in-time: For implementation fees and one-off deliverables

- Milestone-based: Full control over project-based revenue timing

Complex scenarios, handled automatically

- Milestone based revenue recognition.

- Product-level and invoice-level discounts with correct allocation.

- Credit notes that reverse revenue from the right accounts

- Automatically allocated minimum fees and true-ups with point-in-time recognition.

- Export journal entries as CSV files formatted for your specific ERP system.

- Replace manual journal postings with a single file upload.

How it works

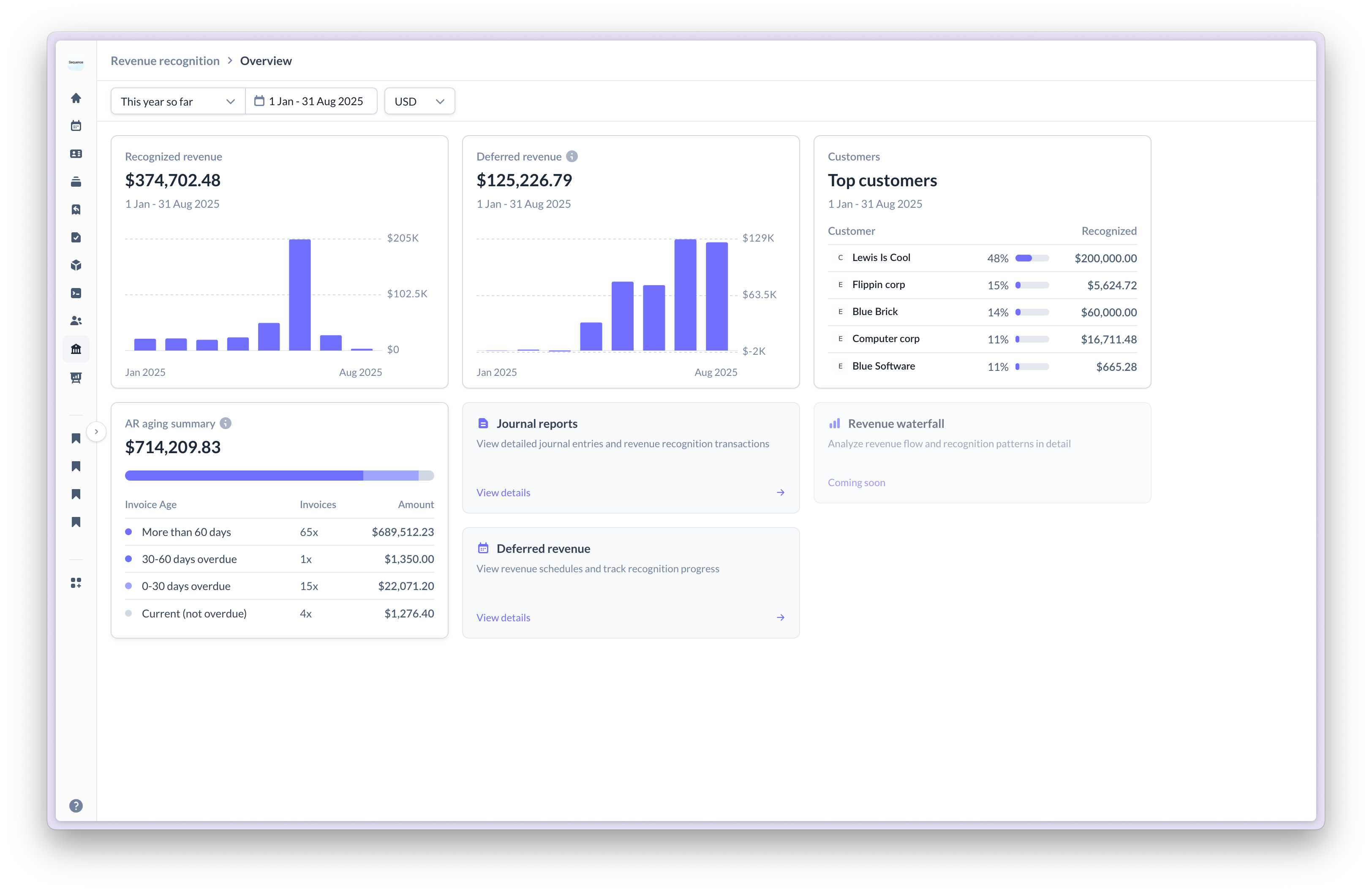

Revenue Recognition integrates directly with your existing Sequence billing schedules and invoices.

Here's the flow:

- Automatic recognition rules: Set recognition methods at the product level or overwrite per invoice line item.

- Daily journal generation: Revenue is recognized based on actual service delivery, not billing timing.

- Monthly reporting: View detailed journal reports with full audit trails

- One-click export: Download formatted CSV files for your ERP system

Built for compliance

Revenue Recognition follows ASC 606 and IFRS 15 standards out of the box:

- Standalone selling price allocation for discounts and minimum true up fees.

- Performance obligation tracking for complex contracts

- Full audit trails with detailed journal entries and supporting documentation

What's next

Revenue Recognition is available in beta - reach out to our team to get access.

We're continuing to expand capabilities based on customer feedback:

- Multi-entity support for companies with complex legal structures

- Advanced reporting with revenue cohort analysis and forecasting

- Additional ERP integrations beyond CSV export

Get started

If you're already a Sequence customer, reach out to our team to get started. Ready to automate your revenue recognition process? Schedule a call with our team to see Revenue Recognition in action.

Merlin Kafka

Related articles

Sequence + Invoice Butler: Close the loop from billing to cash

Modern billing platforms have solved quote-to-cash complexity. Usage-based pricing, multi-year ramps, custom contract terms—Sequence handles all of it. But for most finance teams, the work doesn't end when an invoice is finalized. It ends when the payment hits the bank. That's where Invoice Butler comes in. With our new integration, Sequence customers can now automate the entire path from contract to cash. No manual handoffs between billing and collections. No invoices sitting in portals waiting for someone to upload them. No finance team members chasing down payments that should have arrived weeks ago.

Donal McKeon

Sequence + Rillet: The Modern Finance Stack

The AI-native finance stack is forming, and next-gen ERPs like Rillet are at the center of it. Companies with established systems, such as NetSuite and Stripe Billing, are choosing to build their finance operations on Sequence for quote-to-cash and Rillet as their AI-native general ledger. With our new native integration, these systems now work together seamlessly. This matters because Sequence handles what legacy billing systems can't: multi-year ramped pricing, backdated contracts, percentage-based pricing, flexible usage minimums, mid-contract co-terms, and every other contract variation sales teams actually close. When you pair that flexibility with Rillet's AI-native ERP, finance teams finally get both: the ability to bill any contract accurately and the intelligence to close books in hours instead of weeks.

Killian Cahill

2025 in Review

2025 was our strongest year yet - driven by 10× revenue growth, a $20m Series A, alongside 60+ brand new customer-facing product launches.

Killian Cahill